In today’s digital landscape, ensuring the security of your financial information during online purchases is paramount. Virtual cards offer a robust solution, acting as a protective shield against potential fraud and data breaches. Utilizing a virtual card provides an additional layer of security by masking your actual card details, making it significantly more difficult for malicious actors to compromise your sensitive financial data. Whether you’re a seasoned online shopper or just starting out, understanding the benefits of virtual cards is essential for safeguarding your financial well-being in the digital age. Learn how virtual cards can empower you to make online purchases with confidence and peace of mind.

This article explores the numerous advantages of using virtual cards for online purchases. We will delve into the mechanics of how virtual cards work, providing a clear and concise explanation of their functionality. Furthermore, we will highlight the security benefits that make virtual cards an indispensable tool for modern online shoppers. Discover how virtual cards can mitigate the risks associated with online purchases, empowering you to shop securely and protect your financial information from potential threats. From enhanced security to increased control over your spending, virtual cards offer a range of benefits that make them an essential tool for navigating the world of online purchases.

What Are Virtual Cards?

Virtual cards are digital representations of your physical credit or debit card. They are not physical cards that you can carry in your wallet. Instead, they exist only as a set of unique card details (card number, expiration date, and CVV) generated for online use.

These temporary card numbers act as a buffer between your actual card information and online merchants. This added layer of security helps protect your sensitive financial data from potential fraud or data breaches.

When you make an online purchase using a virtual card, the transaction is processed like a regular credit or debit card payment. The difference is that if the virtual card details are compromised, your primary account remains secure.

Benefits for Online Shopping

Using virtual cards offers several advantages when shopping online. Enhanced security is a primary benefit. By using a temporary card number, you shield your actual credit card information from potential data breaches. This limits the risk of fraud and unauthorized access to your main account.

Increased privacy is another advantage. Virtual cards allow you to make purchases without revealing your personal financial details to merchants. This can be particularly useful on websites you are less familiar with, providing an extra layer of protection against identity theft.

Budgeting control is also simplified with virtual cards. You can set spending limits for each virtual card, helping you manage your online expenses effectively and avoid overspending.

How to Generate Virtual Cards

Generating a virtual card is typically a straightforward process, often completed within your existing online banking platform or through a dedicated virtual card provider’s application.

Step 1: Log in to your online banking account or the virtual card app.

Step 2: Navigate to the virtual card section. The location varies depending on the specific platform, often found under “Cards,” “Security,” or “Virtual Cards.”

Step 3: Select the option to generate or request a new virtual card.

Step 4: You may be prompted to choose a spending limit, validity period, and sometimes a specific merchant for the card to be used with. This enhances security and control over your finances.

Step 5: Confirm the details and generate your virtual card. The platform will then display your virtual card number, expiration date, and CVV. Securely store this information.

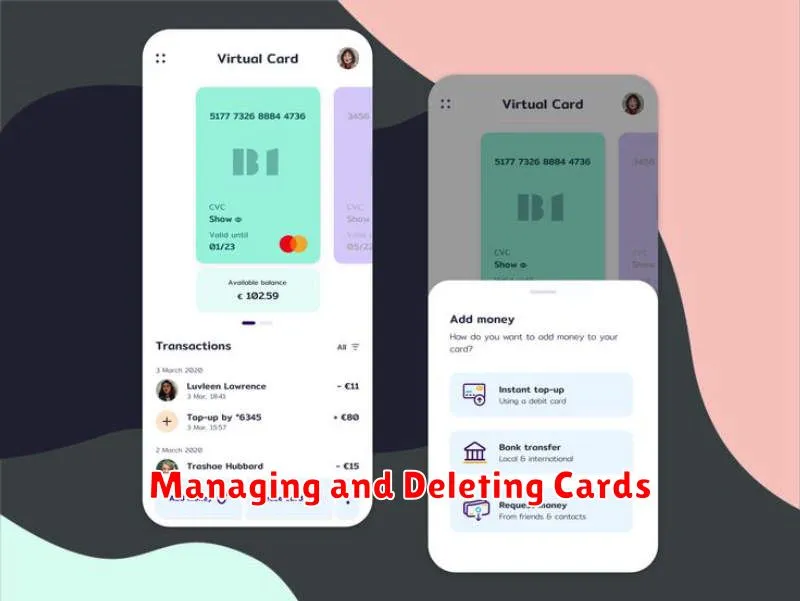

Managing and Deleting Cards

Managing your virtual cards effectively is crucial for maintaining a secure online shopping experience. Most virtual card providers offer a user-friendly interface, typically a dashboard, where you can view and manage all your generated cards. Within this dashboard, you can usually find options to view card details such as the card number, expiration date, and CVV.

Some providers allow you to set spending limits and expiration dates for individual virtual cards. This functionality provides enhanced control over your expenditures, preventing unauthorized charges and minimizing potential losses in case of a data breach.

Deleting a virtual card is generally a straightforward process. Locate the card you wish to delete within your account dashboard. Look for an option labelled “delete,” “remove,” or a similar term. Once a virtual card is deleted, it can no longer be used for online purchases.

Security Advantages Over Physical Cards

Virtual cards offer several key security advantages over their physical counterparts. One primary benefit is the reduced risk of fraud. Since virtual card numbers are randomly generated and can be used for a single transaction or a specific merchant, even if compromised, the damage is limited. Your actual card details remain protected.

Another significant advantage is the increased control you have over your spending. You can set spending limits and expiration dates for each virtual card, mitigating the potential impact of unauthorized charges. This granular control makes virtual cards ideal for subscriptions or recurring payments.

Furthermore, virtual cards provide a layer of anonymity. When shopping online, you’re not revealing your primary card information to the merchant, thus minimizing the risk of your sensitive data falling into the wrong hands. This added privacy is particularly valuable in an era of increasing data breaches.

Limits and Controls Available

Virtual cards offer a range of controls designed to enhance security and manage spending. One key feature is the ability to set spending limits. These limits can be either transaction-specific, capping the amount for a single purchase, or card-wide, restricting the total expenditure allowed on the card.

Expiration dates provide another layer of control. Users can issue virtual cards with short-term validity, ideal for one-time purchases or trial subscriptions. This mitigates the risk of unauthorized charges after the intended use.

Some providers also allow for merchant locking, which restricts the virtual card’s usage to a specific merchant. This feature is particularly beneficial for recurring subscriptions, ensuring that the card cannot be used elsewhere.

Finally, the ability to freeze or cancel a virtual card instantly provides an effective way to stop unauthorized transactions or simply discontinue its use.