In today’s fast-paced world, managing personal finances effectively is more critical than ever. Tracking spending is a fundamental aspect of financial health, allowing individuals to understand where their money goes and make informed decisions about their budget. Thankfully, the rise of digital banking tools has provided unprecedented access to resources that simplify and streamline the process of monitoring expenditures. By leveraging these powerful tools, individuals can gain a comprehensive understanding of their spending habits, identify areas for improvement, and ultimately achieve their financial goals.

This article will explore the numerous benefits of tracking spending with digital bank tools. We will delve into the various features offered by these platforms, such as automated expense categorization, real-time budget tracking, and personalized financial insights. Whether you are looking to curb impulsive spending, save for a major purchase, or simply gain a better grasp of your financial situation, utilizing the digital banking tools available today can empower you to take control of your finances and make tracking spending a seamless and insightful process.

Why Track Your Expenses?

Tracking your expenses provides valuable insights into your financial habits. It allows you to understand where your money is going, identify areas of overspending, and make informed decisions about your budget.

By diligently monitoring your spending, you can gain control over your finances and work towards your financial goals, whether it’s saving for a down payment on a house, paying off debt, or building a retirement fund.

Benefits of expense tracking:

- Increased awareness: See exactly how you spend your money.

- Improved budgeting: Create a realistic budget based on your spending patterns.

- Reduced overspending: Identify and control areas where you tend to overspend.

- Enhanced savings: Find opportunities to save more effectively.

- Achieve financial goals: Make progress towards your financial aspirations.

Using Built-In Budget Tools

Many digital banks offer integrated budgeting tools to help you manage your finances effectively. These tools often provide a centralized view of your spending, categorized by merchant, type of purchase, or custom labels.

Key features of these built-in tools often include:

- Automated categorization: Transactions are automatically categorized, simplifying expense tracking.

- Customizable budgets: Set spending limits for different categories, such as groceries, entertainment, or transportation.

- Real-time alerts: Receive notifications when you approach or exceed your budget limits.

- Visual representations: Charts and graphs help visualize spending patterns and identify areas for improvement.

By leveraging these built-in budget tools, you can gain valuable insights into your spending habits and make informed financial decisions.

Before selecting a digital bank, be sure to research the specific budgeting features offered to ensure they align with your needs.

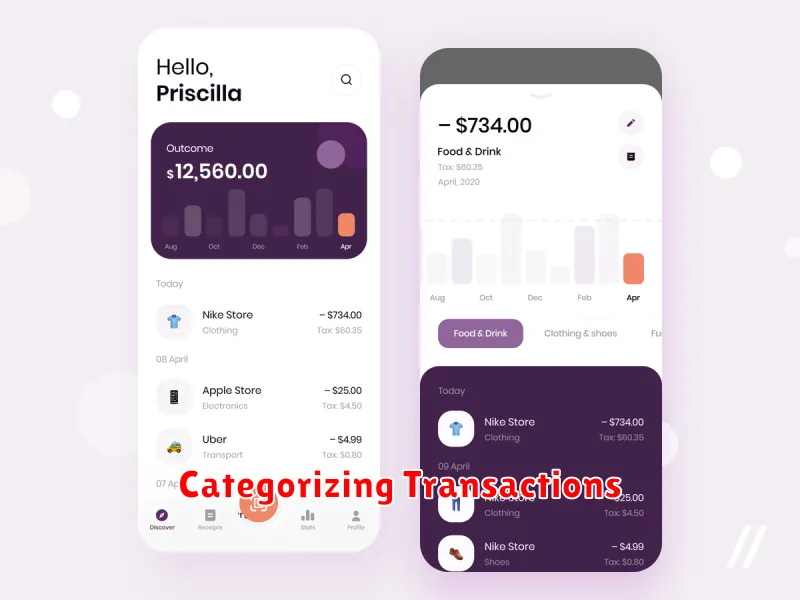

Categorizing Transactions

Categorizing transactions is a crucial step in effectively tracking your spending. Digital banking tools often provide automated categorization features, assigning transactions to predefined categories like “Groceries,” “Transportation,” or “Entertainment.”

However, these automatic assignments might not always be accurate. Regularly reviewing and adjusting these categories ensures the data accurately reflects your spending habits. This allows for more insightful analysis and better budget management.

Most digital banking platforms allow you to create custom categories. This is particularly useful for more granular tracking. For example, you could break down “Entertainment” into subcategories like “Dining Out,” “Movies,” and “Concerts.”

Consistent categorization is key. Establish a clear system and stick to it. This will make it easier to generate reports and analyze your spending trends over time.

Setting Financial Goals

Setting financial goals is a crucial step towards effectively managing your finances. By establishing clear objectives, you provide yourself with direction and motivation for tracking your spending. Digital banking tools can greatly assist in this process.

Consider using the SMART approach when setting goals. Your objectives should be Specific, Measurable, Achievable, Relevant, and Time-bound.

Examples of financial goals include:

- Building an emergency fund.

- Saving for a down payment on a house.

- Paying off debt.

- Investing for retirement.

Once you’ve defined your goals, digital banking tools can help you track your progress. Many platforms offer features such as budgeting tools and savings trackers that allow you to monitor your spending and savings against your established goals.

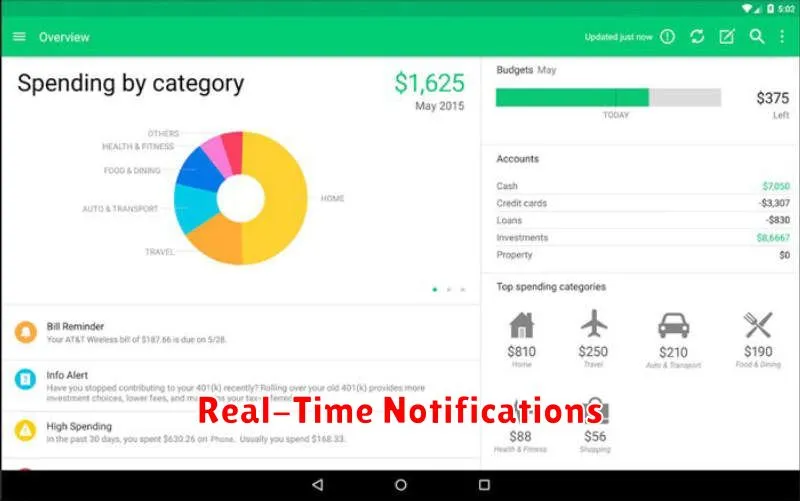

Real-Time Notifications

A key feature of digital banking tools for tracking spending is the ability to receive real-time notifications. These notifications provide instant updates about your account activity, giving you a clear picture of where your money is going.

Common notification types include purchase alerts, deposit notifications, and low balance warnings. These alerts can be customized to fit your specific needs and preferences. For example, you might set a notification for every purchase over a certain amount, or receive an alert when your account balance dips below a specified threshold.

Real-time notifications can be a powerful tool for managing your finances. They provide immediate feedback on your spending habits and can help you identify areas where you might be overspending. This timely information empowers you to make informed financial decisions and stay on top of your budget.

Analyzing Monthly Reports

Monthly reports provided by digital banking tools are crucial for understanding your spending habits. These reports typically categorize transactions, offering a clear overview of where your money is going.

By analyzing these reports, you can identify areas of overspending and potential savings. Regular review allows you to adjust your budget and make informed financial decisions.

Key features to look for in a monthly report include:

- Categorized transactions: Essential for identifying spending trends.

- Spending summaries: Provide a quick overview of your monthly expenditure.

- Trend analysis: Helps visualize changes in spending over time.

Utilize these reports to refine your budgeting strategy and improve your overall financial health. Consistent analysis empowers you to make data-driven adjustments to your spending habits.