In today’s increasingly digital world, mobile wallets have emerged as a prominent payment method, offering a convenient alternative to traditional physical wallets. These digital platforms allow users to store and access various payment instruments, including credit cards, debit cards, loyalty cards, and even digital identification documents, all within the confines of their smartphones or other mobile devices. The rise in popularity of mobile wallets has been driven by factors such as increased smartphone adoption, advancements in near-field communication (NFC) technology, and the growing demand for contactless payment options. Understanding the pros and cons of using mobile wallets is essential for making informed decisions about incorporating this technology into your daily financial activities. This article will explore the advantages and disadvantages of utilizing mobile wallets, covering aspects such as security, convenience, and acceptance.

The debate surrounding the efficacy and safety of mobile wallets continues to be a relevant topic. While proponents emphasize the enhanced convenience and security features, critics raise concerns regarding privacy issues and potential vulnerabilities. By examining the pros and cons of mobile wallets, consumers can determine if the benefits outweigh the risks and whether adopting this technology aligns with their individual needs and preferences. This analysis will encompass a range of considerations, from the ease of use and speed of transactions to the potential limitations and security implications of utilizing mobile wallets. Are mobile wallets the future of finance or a passing trend? Let’s delve deeper into their advantages and disadvantages to arrive at a comprehensive understanding.

What Are Mobile Wallets?

Mobile wallets are digital platforms that allow you to store, manage, and use various payment methods through your mobile device, typically a smartphone or smartwatch. They essentially replace your physical wallet by providing a secure and convenient way to make transactions.

Instead of carrying physical credit cards, debit cards, loyalty cards, and cash, you can store digital versions of these items within the mobile wallet application. This is accomplished through various technologies like Near Field Communication (NFC) for contactless payments, QR codes for scanning, or Magnetic Secure Transmission (MST) which emulates the magnetic stripe on traditional cards.

Mobile wallets offer a streamlined checkout experience. When making a purchase, you simply unlock your device and use the chosen payment method within the app by tapping your phone on a compatible terminal, scanning a QR code, or confirming the transaction digitally.

Convenience and Accessibility

Mobile wallets offer unparalleled convenience, allowing users to make contactless payments swiftly and efficiently. Transactions are completed with a simple tap or scan of a smartphone, eliminating the need to fumble for physical cards or cash. This streamlined process is especially beneficial in fast-paced environments like grocery stores or public transportation.

Accessibility is another significant advantage. Mobile wallets are available 24/7, provided the user has a charged device and network connection. This constant availability makes it possible to conduct transactions anytime, anywhere, offering a level of flexibility unmatched by traditional payment methods. Furthermore, many mobile wallets can be accessed on various devices, including smartphones, smartwatches, and tablets, further enhancing accessibility.

Security and Risks Involved

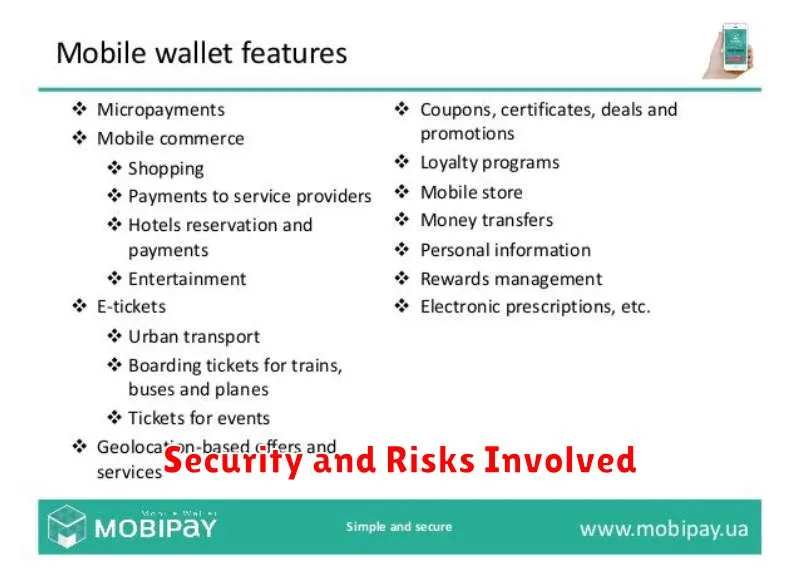

While mobile wallets offer convenience, security remains a key concern. Losing your phone could potentially expose your financial information if not properly secured.

Potential risks include:

- Phone loss or theft: A lost or stolen device can provide unauthorized access to your mobile wallet if not protected with strong passwords or biometric authentication.

- Malware and hacking: Mobile devices are vulnerable to malware that can compromise wallet security and steal sensitive data.

- Security vulnerabilities within the app: Flaws in the mobile wallet app itself could be exploited by hackers.

- Phishing and scams: Users might be tricked into revealing their login credentials through deceptive tactics.

Despite these risks, mobile wallets often incorporate security features like tokenization and encryption to protect user data. Tokenization replaces sensitive card information with unique tokens, making stolen data useless to thieves. Furthermore, biometric authentication adds an extra layer of security.

Supported Devices and Apps

Mobile wallets are generally supported on a wide range of devices, primarily smartphones and smartwatches. Near Field Communication (NFC) technology is essential for contactless payments, and most modern smartphones include this feature. Older devices may not have NFC capabilities, limiting their usability with certain mobile wallets.

Operating systems like iOS and Android both support various mobile wallet applications. Specific apps, such as Apple Pay, Google Pay, and Samsung Pay, have their own requirements and compatibility restrictions. Some apps might be exclusive to a particular operating system or device manufacturer.

Banks and financial institutions also play a significant role. Your bank must support the chosen mobile wallet for you to add your cards and accounts. While most major banks partner with popular wallet providers, confirming compatibility with your specific bank is crucial before attempting to use a mobile wallet.

Integration with Digital Banks

A key advantage of mobile wallets is their seamless integration with digital banking platforms. This allows for real-time fund transfers between accounts, simplifying money management. Users can easily add funds to their wallet directly from their bank account, and in some cases, even withdraw funds back into their account.

This integration also facilitates faster payments. Instead of manually entering card details for online purchases or peer-to-peer transfers, users can simply select their linked bank account or wallet balance within the app, streamlining the checkout process.

Furthermore, the connection between mobile wallets and digital banks enhances security. Utilizing biometric authentication and tokenization methods, transactions are often more secure than traditional card payments, mitigating the risk of fraud and identity theft.

Who Should Use Them?

Mobile wallets can be a beneficial tool for a wide range of individuals. Those who frequently make digital purchases, whether online or in physical stores, can find mobile wallets a more convenient and streamlined payment method. Individuals concerned with security may also appreciate the enhanced security features offered by many mobile wallets, such as tokenization and biometric authentication.

People who are comfortable using smartphones for various tasks are more likely to adopt mobile wallets easily. Additionally, individuals seeking to reduce their reliance on physical cards and embrace a more digital lifestyle are ideal candidates for mobile wallet usage. However, it is important to consider individual needs and preferences, as mobile wallets may not be the optimal solution for everyone.

Tech-savvy individuals who appreciate the convenience of contactless payments and embrace new technologies are a prime target audience. Those living in urban areas with widespread mobile payment acceptance are also more likely to benefit. Finally, people looking to consolidate multiple loyalty cards and payment methods into a single platform can find considerable value in mobile wallets.