Opening a joint account has never been easier thanks to the rise of digital banking. Whether you’re looking to manage shared expenses with a partner, family member, or business associate, a digital joint account offers a convenient and efficient way to handle finances collaboratively. This guide will provide a comprehensive overview of how to open a joint account digitally, outlining the steps involved, required documentation, and key considerations for choosing the right account for your needs. Learn how to navigate the process seamlessly and unlock the benefits of shared banking in the digital age.

From understanding the different types of joint accounts available to comparing features and fees across various digital platforms, we’ll equip you with the knowledge necessary to make informed decisions. Discover the advantages of digital joint accounts, such as 24/7 access, mobile management tools, and streamlined transactions. We’ll also address important security considerations and best practices to ensure the safety and integrity of your shared funds. This guide will provide a step-by-step walkthrough of the digital application process, ensuring a smooth and efficient experience when opening your joint account.

What Is a Joint Account?

A joint account is a bank or credit union account owned by two or more individuals. Each individual, or joint owner, has equal access to the funds and can deposit, withdraw, and manage the account as if they were the sole owner. This shared ownership distinguishes joint accounts from individual accounts.

Key features of a joint account include shared access and responsibility. All owners are legally responsible for the account’s activity, including any overdrafts or debts incurred. It is essential to choose joint owners carefully and establish clear communication about account usage.

Joint accounts are often used for various purposes, such as managing household expenses with a spouse or partner, caring for an elderly parent, or sharing business finances. The type of joint account and its specific features can vary depending on the financial institution.

Benefits of Shared Banking

Shared banking, often facilitated through a joint account, offers numerous advantages for managing finances.

Increased Transparency and Trust: Joint accounts provide a clear overview of shared expenses and income, fostering financial transparency and trust between account holders.

Simplified Bill Payment: Sharing an account streamlines bill payments. Both parties can contribute and access funds for shared expenses such as rent, utilities, and groceries.

Combined Financial Strength: A joint account often improves access to financial products and services. Lenders may consider the combined financial resources of both account holders, potentially resulting in better loan terms or higher credit limits.

Convenient Financial Goal Achievement: Saving for shared goals, like a down payment on a house or a vacation, becomes easier with a joint account. Pooling resources and tracking progress together enhances financial planning and promotes collaborative effort.

Steps to Open Jointly Online

Opening a joint account online typically involves a straightforward process. Both applicants must participate and provide the necessary information.

Begin by selecting the type of joint account you wish to open, such as a checking or savings account. Then, navigate to the financial institution’s website and locate the online application for new accounts.

The application will require personal information from both applicants. This includes full names, addresses, dates of birth, Social Security numbers, and contact information. You may also need to provide identification, such as a driver’s license or passport.

Funding the account is the next step. Most institutions allow you to link an existing account or transfer funds electronically. You will likely need to agree to the account terms and conditions before submitting the application.

Finally, review the application thoroughly to ensure accuracy. Once submitted, the financial institution will process the application. You’ll typically receive confirmation and further instructions via email.

Managing Permissions and Access

Joint accounts typically offer different access levels depending on the financial institution and the type of joint account. Understanding these permissions is crucial before opening the account.

Most joint accounts offer equal access, meaning both account holders have full authority to deposit, withdraw, and manage funds. This is often the default setting.

Some institutions offer limited access options. This might allow one account holder to deposit only, or set withdrawal limits. Inquire about these options if you require more granular control.

Review the terms and conditions carefully to understand the specific permissions granted to each account holder. This often outlines responsibilities and liabilities associated with the account.

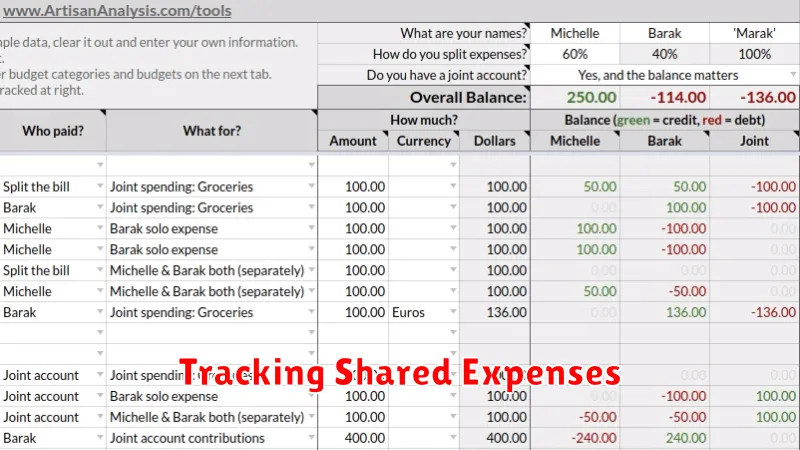

Tracking Shared Expenses

A joint account simplifies shared expense tracking. All transactions are visible to both account holders, providing a transparent record of spending. This eliminates the need for manual tracking methods like spreadsheets or expense-splitting apps.

Regularly reviewing the account activity helps both partners stay informed about shared finances and facilitates open communication about spending habits. This shared awareness can be invaluable in budgeting and achieving financial goals together.

Some banks offer features within their digital platforms to further streamline tracking. These might include categorization tools to analyze spending patterns or budgeting features directly linked to the joint account activity.

Closing or Converting Joint Accounts

Closing a joint account typically requires the agreement of all account holders. Contact your financial institution for their specific requirements, which might include signed documentation from each joint owner. The process may involve closing the account entirely and distributing the remaining funds among the owners.

Converting a joint account to an individual account generally requires the consent of all original account holders. The process may involve closing the existing joint account and opening a new individual account with one of the original owners. Again, contacting your institution directly is crucial to understanding the necessary steps.

Some institutions may allow for the removal of one joint owner, effectively converting the account to a joint account with fewer owners. This, too, usually requires agreement from all current account holders. The remaining balance stays within the account, now under the ownership of the remaining joint owners.