Opening a business account is a crucial step for any entrepreneur. In today’s fast-paced digital world, opening a business account in a digital bank offers numerous advantages. Digital banks provide a streamlined and efficient way to manage finances, often with lower fees and higher interest rates compared to traditional banks. This makes opening a digital business account an attractive option for businesses of all sizes, from startups to established corporations. If you’re considering opening a business account, understanding the benefits of a digital bank is essential for making an informed decision.

This article will guide you through the process of opening a business account in a digital bank. We will cover the key features to look for, the required documentation, and the steps involved in setting up your account. Learn how a digital business account can simplify your financial operations, improve accessibility, and potentially reduce banking costs. Whether you are a seasoned business owner or just starting out, this guide will provide valuable insights into the world of digital business banking and help you choose the right digital bank for your needs. Let’s explore the advantages and procedures involved in opening a business account in a digital bank.

Requirements for Business Accounts

Opening a business account in a digital bank typically requires providing certain documentation and meeting specific criteria. While the exact requirements may vary between institutions, some common prerequisites exist.

Business Identification

You will need to provide legal proof of your business’s existence and structure. This commonly includes your business registration documents, such as articles of incorporation or a certificate of organization. You will also likely need to provide your Employer Identification Number (EIN) or equivalent tax identification number.

Ownership Information

Digital banks require information about the business owners and authorized signatories. Be prepared to provide personal identification documents, such as driver’s licenses or passports, for all relevant individuals. Some institutions may also require details about the business’s ultimate beneficial owners (UBOs).

Business Activity

You may be asked to describe your business activities and intended use of the account. This helps the bank assess the risk associated with your business and comply with regulatory requirements. Be prepared to provide a brief description of your business operations and industry.

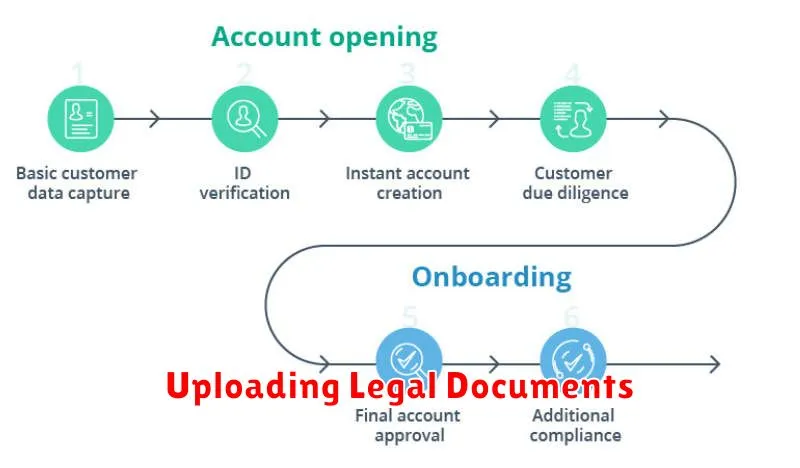

Uploading Legal Documents

This stage involves submitting the necessary legal documents for verification. The required documents may vary based on your business type and location, but commonly include:

- Articles of Incorporation/Organization: This document legally establishes your business.

- Business License/Permit: Proof of your legal authorization to operate within your jurisdiction.

- Ownership Identification: Documentation identifying the business owners, such as passports or driver’s licenses.

- Tax Identification Number (TIN)/Employer Identification Number (EIN): Your business’s tax identification.

Ensure all documents are clear, legible, and up-to-date. The digital bank’s platform will provide specific instructions regarding file formats and sizes. Carefully review these guidelines before uploading to avoid processing delays.

After uploading, the bank will review the documents. This review process may take a few business days. You will likely receive an email notification upon verification completion or if additional information is required.

Setting Up Permissions for Team Members

Once your business account is open, you’ll likely need to grant access to other team members. Digital banks offer granular control over permissions, allowing you to tailor access based on individual roles and responsibilities.

Assigning Roles: Typically, you can assign predefined roles, such as “Administrator,” “Viewer,” “Payment Approver,” or “Accountant.” These roles come with a preset package of permissions.

Customizing Permissions: For more specific needs, you can often customize permissions. This allows you to grant access to certain features, like initiating payments, viewing transaction history, or managing user accounts, while restricting others.

Reviewing Access: Regularly review the assigned permissions to ensure they are still appropriate. Remove access for team members who no longer require it for enhanced security.

Managing Invoices and Payments

Digital business accounts often offer streamlined invoice and payment management tools. These features can significantly reduce the administrative burden associated with running your business.

Invoice Creation: Many platforms allow you to generate and send professional invoices directly from your account. You can often customize these invoices with your business logo and details.

Payment Processing: Accepting payments is crucial for any business. Digital banks frequently integrate with various payment processors, enabling you to receive payments swiftly and securely. Some may offer features like recurring billing for subscription services.

Automated Payments: Schedule payments to vendors and suppliers to ensure timely disbursements and avoid late fees. This automation can help you maintain strong vendor relationships and improve your business’s financial health.

Tracking and Reporting: Gain a clear overview of your cash flow with robust tracking and reporting tools. These features allow you to monitor incoming and outgoing payments, identify trends, and make informed financial decisions.

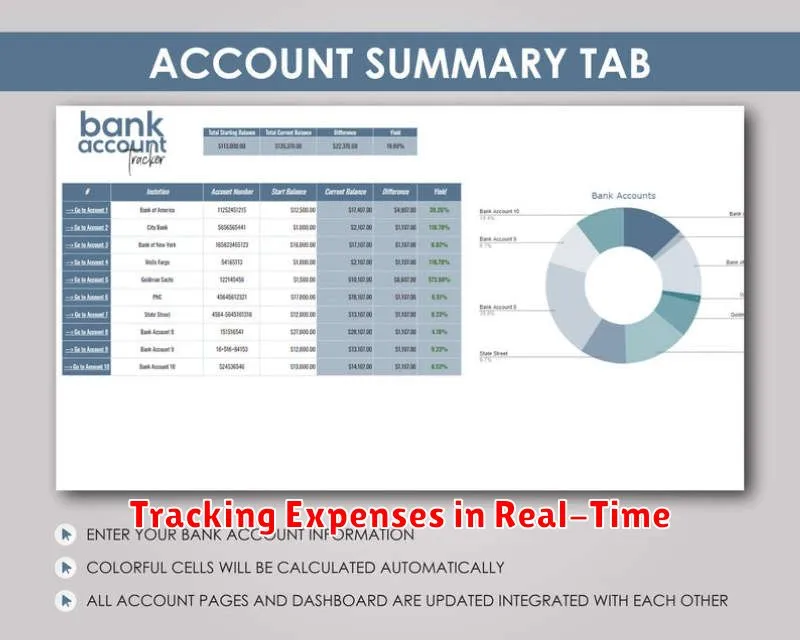

Tracking Expenses in Real-Time

One of the significant advantages of a digital business account is the ability to track expenses in real-time. This immediate access to financial data provides valuable insights into your business’s cash flow.

No more waiting for monthly statements. With real-time tracking, you can monitor transactions as they occur, allowing you to identify spending patterns and potential areas for cost savings quickly.

This feature simplifies budget management significantly. You can readily compare your actual spending against your projected budget, making necessary adjustments to maintain financial stability.

Real-time expense tracking also aids in accurate reporting. By having up-to-the-minute information, you can generate financial reports quickly and efficiently, crucial for timely decision-making and stakeholder communication.

Choosing the Right Business Plan

Selecting the appropriate business plan with a digital bank is crucial for maximizing benefits and managing finances effectively. Different plans cater to varying business needs, transaction volumes, and growth stages.

Consider your projected transaction volume. High-volume businesses may benefit from plans offering unlimited transactions or tiered pricing structures. Smaller businesses with fewer transactions might find plans with transaction limits more cost-effective.

Evaluate the features offered in each plan. Some plans may provide integrations with accounting software, dedicated account managers, or prioritized customer support. Assess which features align with your business requirements.

Fee structures vary significantly. Analyze the monthly fees, transaction fees, and any other associated costs. Ensure the chosen plan aligns with your budget and financial projections.