In today’s digital age, online banking has become an indispensable part of life. The convenience of managing finances anytime, anywhere is undeniable. However, with this convenience comes a heightened need for robust security measures. It’s crucial for financial institutions to prioritize the safety of their customers’ sensitive information. This article will explore the essential security features every online bank should offer to protect against fraud and cyber threats. Understanding these features empowers consumers to make informed decisions and choose banks that prioritize their financial security.

From multi-factor authentication to encryption and fraud detection, several key security features are paramount in safeguarding online banking transactions. We’ll delve into these features, explaining how they work and why they’re essential for a secure online banking experience. By understanding the security landscape and the measures that reputable banks employ, you can confidently navigate the world of online finance, knowing your financial assets are protected by the latest and most effective security practices.

Encrypted Connections

Encryption is fundamental to online banking security. It scrambles data transmitted between your device and the bank’s server, making it unreadable to potential eavesdroppers. Look for HTTPS in the website address bar, indicated by a padlock icon. This signifies a secure connection using Secure Sockets Layer (SSL) or Transport Layer Security (TLS) encryption.

These protocols establish an encrypted channel, protecting sensitive information like login credentials, account details, and transaction data. Strong encryption is crucial for preventing unauthorized access and maintaining the confidentiality of your financial activities.

Two-Factor Authentication

Two-factor authentication (2FA) is a critical security feature that adds an extra layer of protection beyond just a username and password. It requires users to provide two different authentication factors to verify their identity, significantly reducing the risk of unauthorized access, even if a password is compromised.

Typically, 2FA involves something the user knows (like a password) and something the user has (like a one-time code generated by an authenticator app or sent via SMS). This makes it much harder for attackers to gain access to an account, as they would need both pieces of information.

Banks should offer various 2FA methods to cater to user preferences and device availability. Common options include:

- Authenticator Apps: These apps generate time-based one-time passwords (TOTPs) and are considered the most secure option.

- SMS Codes: While less secure than authenticator apps, SMS codes provide a convenient alternative for users without smartphones.

- Hardware Tokens: Physical devices that generate one-time codes.

Requiring 2FA for all sensitive operations, such as logins, fund transfers, and changes to account settings, is essential for ensuring account security.

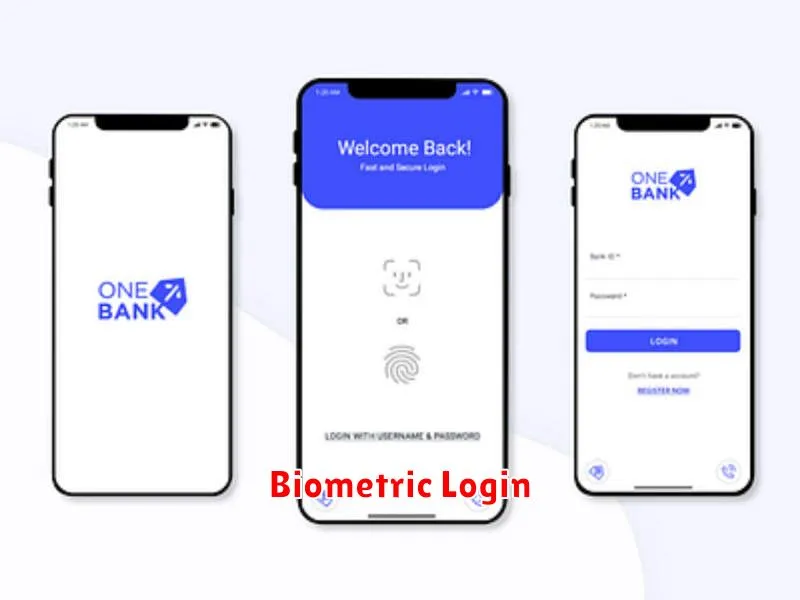

Biometric Login

Biometric login adds an extra layer of security beyond traditional username and password combinations. It uses unique biological markers to verify user identity.

Common biometric authentication methods include fingerprint scanning, facial recognition, and voice recognition. These methods make it significantly more difficult for unauthorized access, as these biological traits are extremely difficult to replicate.

Biometric login offers increased convenience for users, eliminating the need to remember complex passwords. It also provides enhanced security against common threats like phishing and keylogging.

While implementation costs can be higher than traditional login methods, the added security and user experience benefits often outweigh the initial investment.

Instant Fraud Alerts

Instant fraud alerts are a crucial security feature for online banking. These alerts notify you in real-time of any suspicious activity on your account, such as unauthorized transactions or login attempts. This immediacy allows you to react quickly and potentially prevent significant financial losses.

Typically, these alerts are delivered via multiple channels, including SMS messages, email notifications, and push notifications through the bank’s mobile app. The specific delivery methods offered can vary between institutions.

Effective fraud alerts provide detailed information about the potentially fraudulent activity, such as the transaction amount, location, and merchant involved. This information empowers you to quickly assess the legitimacy of the activity and take appropriate action.

Automatic Logout and Timeout

Automatic logout and session timeout features are crucial for online banking security. These mechanisms automatically log a user out of their account after a period of inactivity. This helps mitigate the risk of unauthorized access if a user leaves their computer or device unattended while logged in.

A reasonable timeout period should be implemented, balancing security with user convenience. Generally, a timeout of 5-10 minutes is considered a good practice. Users should be clearly notified of the impending timeout and given the option to extend their session if necessary.

Implementing these features significantly reduces the window of opportunity for attackers to gain access to sensitive financial information. This protection is particularly important in cases of shared computers or devices.

Device Management Tools

Device management offers crucial security features that empower users to control access to their online banking accounts from various devices. These tools provide a layer of protection against unauthorized access and potential fraud.

Key features of robust device management tools include:

- Registered Device Management: Users should be able to view a list of devices currently logged into their accounts and have the ability to deregister devices they no longer use or recognize.

- Device Recognition: The system should be able to identify new devices attempting to access the account and alert the user. Ideally, this would involve multi-factor authentication for new device logins.

- Remote Device Wipe: In cases of theft or loss, users should have the ability to remotely wipe their banking data from a compromised device.

These features provide customers with greater control and peace of mind, knowing they can actively manage and secure their online banking access from any device.