In today’s increasingly digital world, mobile banking offers unparalleled convenience. Managing your finances from anywhere, at any time, is undoubtedly appealing. However, this convenience comes with inherent risks. Protecting your mobile bank account is paramount to safeguarding your financial well-being. This article provides essential guidance on how to keep your mobile banking experience secure, covering key aspects from password management to recognizing and avoiding common scams. Learn how to protect your sensitive financial information and enjoy the benefits of mobile banking with peace of mind.

Mobile banking security is not just a recommendation; it’s a necessity. From sophisticated phishing attacks to malware designed to steal your credentials, the threats are real and constantly evolving. Understanding the potential risks and taking proactive steps to mitigate them is crucial. This article will equip you with the knowledge and practical tips necessary to secure your mobile bank account and prevent unauthorized access. We’ll delve into best practices for mobile banking safety, ensuring you have the tools to stay one step ahead of potential threats.

Use Strong and Unique Passwords

Protecting your mobile banking account starts with a strong password. A strong password is one that is difficult for others to guess or crack using automated tools.

Characteristics of a strong password include:

- A minimum of 12 characters

- A mix of uppercase and lowercase letters

- Numbers and symbols

- Avoids common words, phrases, and personal information (like your birthday or pet’s name).

Uniqueness is also crucial. Don’t reuse the same password for multiple accounts, especially your mobile banking and email. If one account is compromised, all accounts using that password become vulnerable.

Consider using a password manager to generate and securely store strong, unique passwords for each of your online accounts. This simplifies password management while enhancing security.

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your mobile banking account, making it significantly more difficult for unauthorized individuals to gain access. Activating 2FA should be a top priority.

With 2FA enabled, logging in requires not only your username and password but also a second factor, typically a unique, time-sensitive code. This code is usually generated by an authenticator app on your phone or sent to you via text message. This means that even if someone steals your password, they still won’t be able to access your account without that second factor.

Most mobile banking apps offer 2FA. Check your app’s security settings to enable it. You’ll typically be presented with options for receiving your codes, such as an authenticator app or SMS. Authenticator apps are generally considered more secure.

Avoid Public Wi-Fi for Transactions

Public Wi-Fi hotspots are convenient, but they often lack robust security measures. This makes them attractive targets for hackers seeking to intercept data.

When you use public Wi-Fi for mobile banking, you risk exposing your login credentials, account numbers, and other sensitive information. Cybercriminals can use various techniques, such as “man-in-the-middle” attacks, to eavesdrop on your connection and steal your data.

If you must conduct a transaction while on the go, it’s strongly recommended to use your mobile carrier’s data network. While not foolproof, cellular data generally offers better security than public Wi-Fi.

Alternatively, wait until you can access a secure and trusted network, such as your home Wi-Fi, before performing any mobile banking transactions.

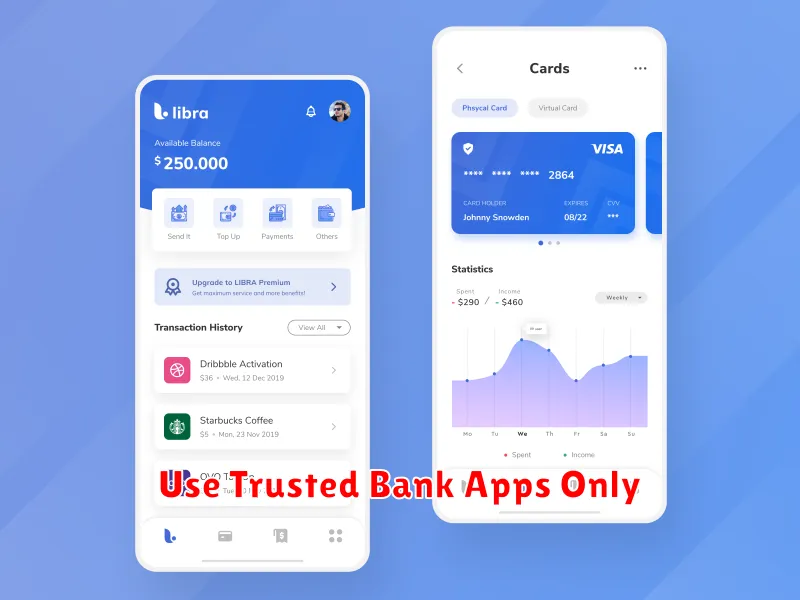

Use Trusted Bank Apps Only

Never download banking apps from untrusted sources. Always download your bank’s app directly from the official app store (Google Play Store for Android or Apple App Store for iOS). These platforms have security measures in place to help ensure the apps are legitimate.

Verify the app’s authenticity by checking the developer’s information. It should match your bank’s name and contact information. Look for reviews and ratings from other users, but be aware that even these can be manipulated. If anything seems suspicious, contact your bank directly.

Avoid using third-party app stores or downloading APK files from websites, as these can be sources of malware disguised as banking apps. These fake apps could steal your login credentials and other sensitive information.

Monitor Transactions Regularly

Regularly reviewing your mobile banking transactions is crucial for maintaining account security. This allows you to quickly identify any unauthorized activity and take immediate action.

Make it a habit to check your account daily or every few days. Look for any transactions you don’t recognize, even small ones. These could be signs of fraudulent activity.

Key things to look for:

- Unfamiliar purchases

- Withdrawals you didn’t make

- Transfers to unknown accounts

- Any discrepancies in balances

If you notice anything suspicious, immediately contact your bank. Early detection can significantly limit potential losses and help protect your financial information.

Report Suspicious Activity Immediately

Time is of the essence when dealing with potential fraud. If you notice any unauthorized transactions, login attempts, or unusual account activity, report it to your bank immediately.

This includes:

- Missing funds

- Unrecognized purchases

- Password change attempts you didn’t initiate

- Suspicious emails or text messages appearing to be from your bank

Most banks have 24/7 customer service available specifically for reporting fraud. Contact them through the official phone number listed on your bank’s website or the back of your debit/credit card.

The sooner you report suspicious activity, the faster your bank can take action to protect your account and limit potential losses.