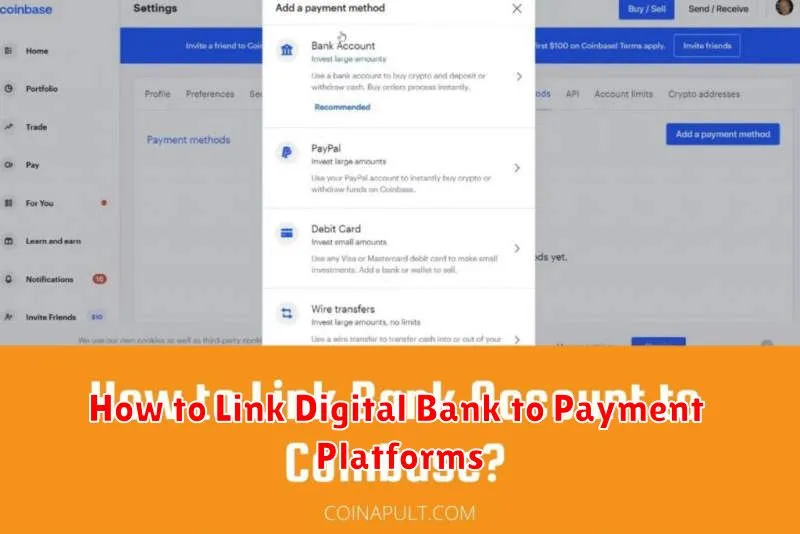

In today’s increasingly digital world, managing finances efficiently is paramount. Linking your digital bank to various payment platforms offers unparalleled convenience and control over your transactions. This comprehensive guide will provide a step-by-step approach to seamlessly connect your digital bank account to popular payment platforms, enabling you to make payments, transfer funds, and manage your money with ease. Whether you’re looking to streamline online shopping, send money to friends and family, or simply keep track of your spending, understanding how to link your digital bank is essential.

This article will cover various digital banking platforms and payment platforms, offering clear instructions on how to establish these crucial connections. Learn the benefits of linking your accounts, the security measures to consider, and troubleshooting tips for common issues. Master the art of linking your digital bank to payment platforms and unlock a new level of financial management. This guide will empower you to navigate the digital financial landscape with confidence and efficiency, maximizing the potential of your digital bank account and preferred payment platforms.

Supported Payment Platforms

This article outlines the payment platforms currently compatible with linking your digital bank account. Compatibility may vary depending on your specific digital bank and region. Always confirm support with your bank before attempting to link your account.

Popular Payment Platforms

Many widely used payment platforms are supported, including:

- Peer-to-Peer Payment Apps: These apps often allow for seamless transfers using your linked bank account.

- Mobile Wallets: Add your digital bank account to your mobile wallet for convenient in-store and online purchases.

- Online Retailers: Many online retailers accept direct payments from linked bank accounts during checkout.

- Bill Payment Services: Utilize your digital bank account to manage and pay bills electronically through various service providers.

Regional Variations

Some payment platforms may have limited regional availability. Ensure the platform you intend to use operates in your area and supports your specific digital bank.

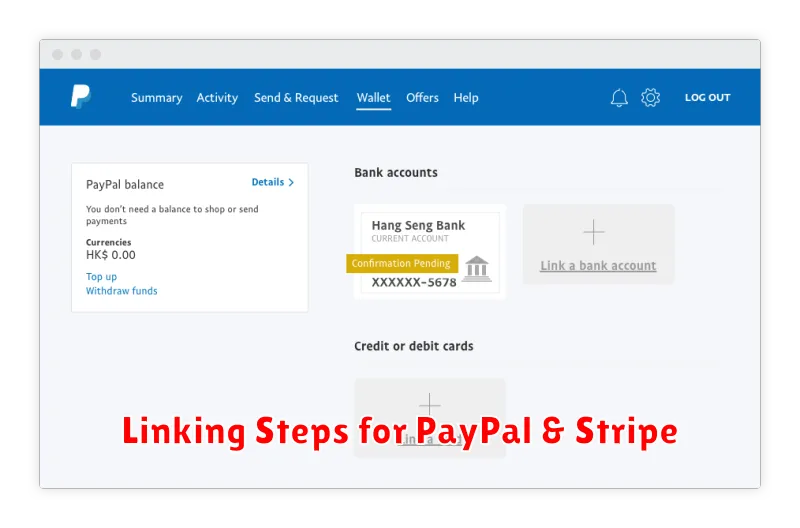

Linking Steps for PayPal & Stripe

Connecting your digital bank account to payment platforms like PayPal and Stripe allows for seamless transfer of funds. It’s crucial to follow the specific linking instructions for each platform to ensure successful integration.

PayPal Linking

Generally, linking to PayPal involves adding your digital bank account as either a payment method or a withdrawal method. You’ll need to provide your digital bank’s routing number and account number. PayPal may then make small deposits for verification purposes, which you’ll need to confirm within your digital banking platform.

Stripe Linking

Stripe typically requires linking a bank account for receiving payouts. Similar to PayPal, providing the routing number and account number of your digital bank account is necessary. Verification may involve confirming micro-deposits or answering questions about your account details. Always verify the information you enter to prevent delays or errors in processing.

Verifying Micro-Deposits

After initiating the micro-deposit verification process, your selected digital bank will send two small deposits (typically under $1.00) to your linked bank account. This process usually takes one to two business days.

These deposits will appear on your linked account statement with specific descriptions, often including the digital bank’s name or a verification code. You’ll need to locate these deposits to complete the verification.

Carefully note the exact amounts of the two deposits. You’ll then return to your digital bank platform and enter these amounts in the designated verification fields.

Accurate entry is crucial. Incorrect amounts will prevent successful verification, and you might need to restart the process.

Once the amounts are correctly entered and submitted, the connection between your digital bank and the payment platform will be established.

Security Tips When Linking

Linking your digital bank account to payment platforms offers convenience, but it’s crucial to prioritize security. Never share your banking login credentials with any third-party platform. Verify the legitimacy of the payment platform before linking. Look for secure connections (HTTPS) and research the platform’s reputation.

Regularly monitor your bank statements and transaction history for any unauthorized activity. Set up transaction alerts to receive notifications for every transaction. This allows you to quickly identify and address any suspicious activity. Consider using strong, unique passwords for both your bank account and payment platforms. Avoid using the same password for multiple accounts.

If a payment platform requests more information than necessary, reconsider linking your account. Legitimate platforms typically only require essential information to process transactions. When using public Wi-Fi, exercise extra caution when accessing your financial accounts or making transactions. Public Wi-Fi networks can be vulnerable to security breaches.

Troubleshooting Failed Connections

Experiencing difficulties linking your digital bank account to a payment platform? Several factors can contribute to failed connections. Follow these steps to diagnose and resolve the issue.

Verify Account Information

Double-check all entered information. Ensure your account and routing numbers are accurate. A single incorrect digit can prevent a successful connection. Confirm that your digital bank account is eligible for linking to external platforms. Some accounts may have restrictions.

Check Bank and Platform Status

Occasionally, outages or scheduled maintenance can disrupt the connection process. Visit your digital bank’s website or app and the payment platform’s status page to check for any reported issues.

Contact Customer Support

If the problem persists, contact customer support for both your digital bank and the payment platform. They can provide personalized assistance and investigate potential underlying technical problems.

Unlinking Services Safely

Disconnecting your digital bank account from payment platforms requires careful consideration to protect your financial information. Before initiating the unlinking process, ensure all pending transactions are completed to avoid complications.

Navigate to the linked accounts or settings section of your chosen payment platform. Locate the specific digital bank account you wish to unlink. Follow the platform’s instructions for removing the connection. This may involve clicking an “unlink” button or selecting a “remove” option.

After unlinking, verify the disconnection. Check your payment platform to confirm the digital bank account is no longer listed. It is also advisable to review your recent digital bank statements to ensure no unauthorized transactions occur after the unlinking process.

If you encounter any difficulties or have security concerns, contact customer support for both your digital bank and the payment platform. They can provide specific guidance and address any issues promptly.