In today’s fast-paced digital world, managing your finances efficiently and conveniently is paramount. A digital bank app offers the perfect solution, providing access to your accounts, transactions, and various financial tools at your fingertips. Choosing the right digital banking app, however, can be overwhelming with the multitude of options available. This article explores the crucial features to consider when selecting a digital bank app that best suits your needs, ensuring a seamless and secure banking experience.

Navigating the world of digital banking requires careful consideration of factors such as security, functionality, and fees. Understanding these key aspects will empower you to make an informed decision and select a digital bank app that aligns with your financial goals and lifestyle. From robust security measures to convenient features like mobile check deposit and budgeting tools, the ideal digital bank app can simplify your financial life. Let’s delve into the essential features you should look for when choosing a digital bank app.

Simple Interface and Navigation

A crucial aspect of a user-friendly digital banking app is its interface and navigation. A clean, intuitive design allows for effortless account management. Look for an app that prioritizes simplicity. Overly complex menus and cluttered screens can lead to frustration and difficulty in completing tasks efficiently.

Key features to consider include a well-organized dashboard that provides a clear overview of your accounts and balances. Easy-to-find transaction history, bill pay options, and transfer functionalities are also essential. The app should offer seamless navigation between different sections without requiring numerous steps or complex processes. A search function can further enhance the user experience, enabling quick access to specific information or transactions.

Fast Login and Security Features

Security and speed are paramount when choosing a digital banking app. Look for features that streamline the login process without compromising your financial safety.

Biometric login, such as fingerprint or facial recognition, offers a quick and secure way to access your account. This is often preferable to repeatedly entering passwords.

Two-factor authentication (2FA) adds an extra layer of security. While sometimes adding a few seconds to the login process, 2FA significantly reduces the risk of unauthorized access. Ensure the app supports 2FA and understand how it’s implemented.

Consider the password recovery process. It should be secure yet user-friendly, allowing you to regain access if you forget your login credentials. However, it should also be robust enough to prevent unauthorized access.

Customizable Alerts

Control over your finances is enhanced by customizable alerts. A good digital banking app should allow you to tailor alerts to your specific needs. This means you can choose which types of notifications you receive and how you receive them (push notification, email, or SMS).

Consider the essential alerts you might want to configure:

- Low balance alerts

- Deposit notifications

- Unusual activity alerts

- Bill payment reminders

- Large transaction notifications

The ability to customize these alerts helps you stay informed about your account activity without being overwhelmed by unnecessary notifications. Look for an app that allows for granular control, enabling you to specify thresholds and categories for your alerts.

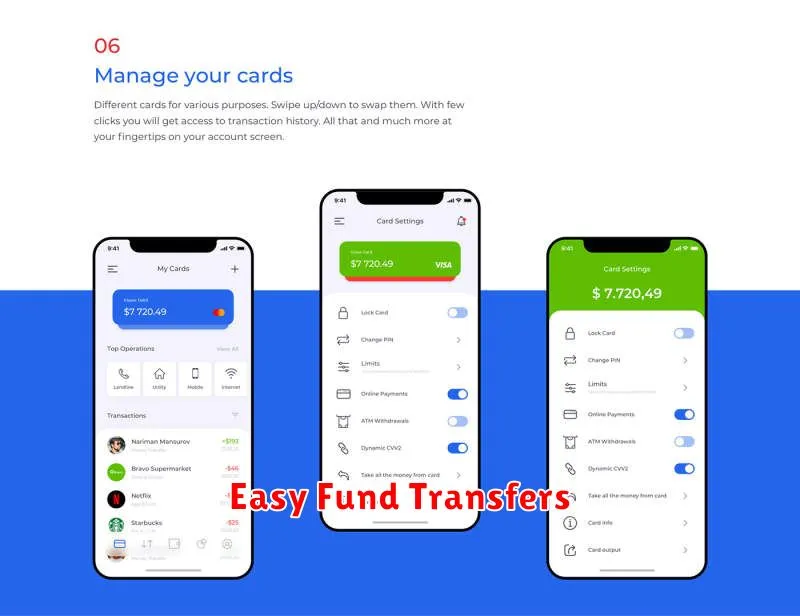

Easy Fund Transfers

A key feature of any good digital banking app is the ability to transfer funds quickly and easily. Look for an app that allows you to transfer money between your own accounts, as well as to external accounts, with minimal steps. Real-time transfers are preferable, eliminating the waiting period often associated with traditional banking.

The transfer process should be intuitive and user-friendly. Clearly labeled options and a straightforward interface are crucial. The app should also offer various transfer methods, such as using account numbers, registered payees, or even mobile phone numbers.

Security is paramount when transferring funds. Ensure the app utilizes robust security measures, such as multi-factor authentication and encryption, to protect your transactions. A clear transaction history log should also be readily accessible for tracking and verification purposes.

In-App Support and FAQs

Effective customer support is crucial within a digital banking app. Look for features like a comprehensive FAQ section that addresses common questions and concerns. This self-service option allows users to quickly find solutions without needing to contact support.

Beyond FAQs, in-app chat or messaging features can provide direct assistance. This real-time support option is invaluable for resolving complex issues or handling urgent requests. Check whether support agents are available 24/7 or during specific business hours.

A well-designed app should seamlessly integrate these support features within the user interface, making it easy to access help when needed. Consider the availability of different support channels, like email or phone contact, for issues that require escalation.

Frequent Updates and Bug Fixes

A reliable digital banking app should be regularly updated. Frequent updates demonstrate the bank’s commitment to security, performance improvements, and addressing user feedback. Check the app’s update history in the app store. A consistent flow of updates, even minor ones, is a good sign.

Bug fixes are equally crucial. While no app is entirely bug-free, a well-maintained app will have its bugs promptly addressed. Look for information on bug fixes within the update descriptions. This indicates that the development team is actively working to resolve issues and enhance the user experience.

A stagnant app with infrequent updates can signal potential security vulnerabilities and a lack of ongoing development. This can be a red flag, suggesting the app may not be a reliable choice for managing your finances.