In today’s rapidly evolving financial landscape, digital banks are transforming the way we interact with our finances. Understanding the user experience (UX) offered by these platforms is crucial for both consumers and industry professionals. This article provides a comprehensive comparison of the user experience across several leading digital banks, examining key aspects such as account opening, mobile app functionality, customer support, and overall user interface design. We will delve into the strengths and weaknesses of each platform, ultimately aiming to help you determine which digital bank provides the best user experience tailored to your specific needs.

Navigating the world of digital banking can be challenging, with a plethora of options boasting various features and functionalities. This comparison will focus on the core elements that contribute to a positive user experience, including ease of navigation, transaction management, security features, and personalization options. By analyzing these critical components, we aim to equip you with the knowledge necessary to make informed decisions about which digital bank best aligns with your user experience expectations and financial goals. Join us as we explore the diverse landscape of digital banking UX and uncover the key differentiators that set these platforms apart.

What Makes a Good UX?

Good UX, or user experience, is paramount in digital banking. It hinges on several key factors that contribute to a positive and efficient interaction for the user.

Usability is crucial. A good UX facilitates easy navigation and completion of tasks. Users should be able to intuitively find what they need and perform actions without friction.

Accessibility ensures that the platform is usable by everyone, including those with disabilities. This encompasses elements like clear typography, sufficient color contrast, and keyboard navigation.

Performance is another critical aspect. A fast and responsive interface minimizes frustration and encourages continued use. Slow loading times or lag can significantly detract from the user experience.

Finally, design plays a vital role. A visually appealing and well-organized interface enhances the overall experience and builds trust. A clean, modern design fosters a sense of professionalism and security.

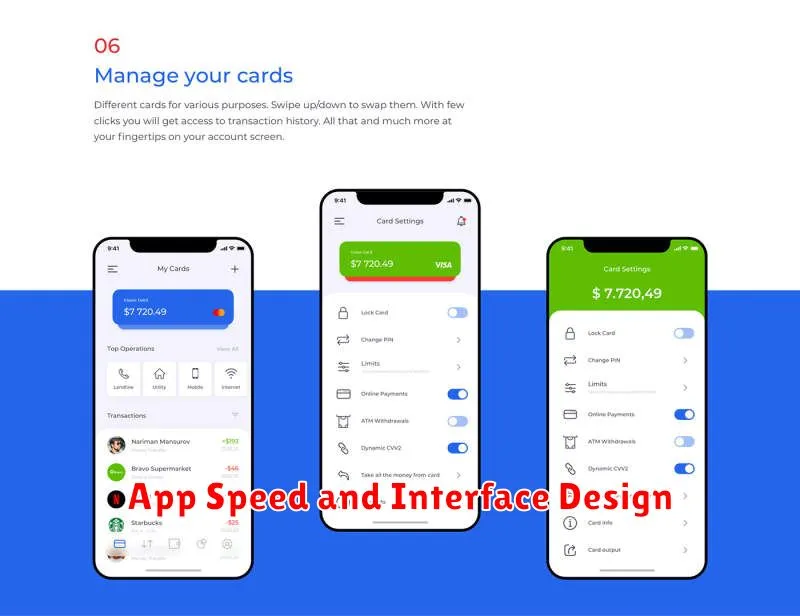

App Speed and Interface Design

A critical aspect of user experience in digital banking is the speed and responsiveness of the app. Customers expect quick loading times and seamless transitions between screens. A slow or laggy app can lead to frustration and negatively impact the overall user experience.

Interface design plays a crucial role in usability. A well-designed interface should be intuitive and easy to navigate, allowing users to quickly and efficiently complete their desired tasks. Key elements to consider include clear visual hierarchy, consistent design language, and accessible controls. Effective use of whitespace and typography also contribute to a positive user experience.

Analyzing app speed often involves measuring load times for key features, such as logging in, transferring funds, and viewing account balances. Interface design evaluation typically involves heuristic analysis and user testing to identify areas for improvement in navigation, layout, and overall usability.

Ease of Onboarding Process

A seamless onboarding experience is crucial for attracting and retaining customers in the digital banking landscape. This section evaluates the ease with which users can open an account and begin using the platform’s core features.

Key factors considered include the time required to complete the application, the clarity of instructions, and the number of steps involved. A streamlined process with minimal friction points contributes significantly to a positive first impression.

We assessed the onboarding process based on criteria such as:

- KYC (Know Your Customer) procedures: How efficient and user-friendly was the identity verification process?

- Document submission: Was it easy to upload required documents?

- Account activation: How quickly was the account activated after application submission?

Differences in onboarding efficiency can significantly impact user satisfaction. A cumbersome process may deter potential customers, while a smooth and intuitive experience encourages engagement and fosters trust.

Navigation and Accessibility

Navigation plays a crucial role in the overall user experience of a digital banking platform. A well-designed navigation system allows users to quickly and easily find the features and information they need. This section compares the navigational efficiency and intuitiveness across the selected digital banks.

Key aspects of navigation being assessed include the clarity of menus and labels, the effectiveness of search functionality, and the overall information architecture. Ease of navigating between different sections of the app, such as account summaries, transactions, and bill pay, is also considered.

Accessibility features are essential for ensuring that digital banking services are inclusive and usable for all individuals, including those with disabilities. This comparison examines the accessibility features offered by each digital bank, considering factors such as screen reader compatibility, keyboard navigation support, and options for customizing font sizes and colors.

The presence and effectiveness of accessibility features are assessed based on established accessibility guidelines. This ensures that the comparison provides a meaningful evaluation of the digital banks’ commitment to inclusivity.

User Support and Help Center

A critical aspect of user experience in digital banking is the accessibility and effectiveness of customer support. Response times, communication channels, and the quality of assistance provided significantly impact user satisfaction. This section compares the user support and help center features offered by different digital banks.

Key factors to consider include:

- Availability of 24/7 support: Does the bank offer round-the-clock assistance?

- Multiple contact channels: Are users able to reach support through various methods such as in-app chat, email, phone, or social media?

- Help center resources: Is there a comprehensive online knowledge base with FAQs, tutorials, and troubleshooting guides?

- Clarity and effectiveness of support documentation: Is the information easy to understand and helpful in resolving common issues?

Evaluating these elements provides valuable insight into the overall user experience and can highlight potential pain points for customers seeking assistance.

Real Customer Feedback

Understanding user experience requires examining real customer feedback. This section provides a glimpse into the experiences of actual users across the digital banks discussed.

Feedback Themes

Several key themes emerged from analyzing customer reviews and feedback:

- Ease of Use: Customers frequently mentioned the importance of a clean, intuitive interface and seamless navigation.

- Customer Service: The responsiveness and helpfulness of customer support played a significant role in shaping user perception.

- Features and Functionality: The availability of desired features, such as budgeting tools and mobile check deposit, greatly influenced satisfaction.

- Security: Users emphasized the importance of feeling secure when managing their finances digitally.

Example Feedback

| Bank | Feedback |

|---|---|

| Bank A | “The app is very easy to use and I appreciate the real-time notifications.” |

| Bank B | “Customer service was incredibly helpful when I had an issue with a transaction.” |

| Bank C | “I wish they offered more robust budgeting features.” |