The rise of the freelance economy has brought with it a unique set of financial challenges. Traditional banking systems often fall short in meeting the specific needs of freelancers, who require flexibility, accessibility, and tailored financial tools to manage their income and expenses effectively. Freelancers face unpredictable income streams, international transactions, and the need for seamless integration with online platforms. This is where digital banks step in, offering a modern and comprehensive solution to the financial complexities of freelance work. They provide freelancers with the tools they need to thrive in the gig economy.

This article will explore how digital banks are revolutionizing financial management for freelancers. We’ll examine the key features and benefits that make them ideal for the independent workforce, including lower fees, multi-currency accounts, efficient invoicing systems, and real-time expense tracking. Discover how digital banks empower freelancers to take control of their finances, streamline their operations, and achieve greater financial stability in the ever-evolving world of independent work. By leveraging the advantages of digital banking, freelancers can navigate the unique financial landscape of their profession with confidence and ease.

Flexible Account Types

Digital banks often offer a range of account types tailored to the specific needs of freelancers. These accounts may include options like business checking accounts, personal checking accounts, and savings accounts, all accessible within a single platform. This streamlined approach simplifies financial management for freelancers who often juggle multiple income streams and expenses.

Some digital banks also offer specialized account types designed specifically for freelancers, with features such as invoicing integration, expense tracking, and tax estimation tools. These features allow freelancers to efficiently manage their finances directly within their banking platform, saving valuable time and effort.

The flexibility offered by digital banks extends to account opening procedures as well. Freelancers can typically open accounts quickly and easily online, without the need for extensive paperwork or branch visits. This ease of access is particularly beneficial for those just starting out or operating in a fast-paced environment.

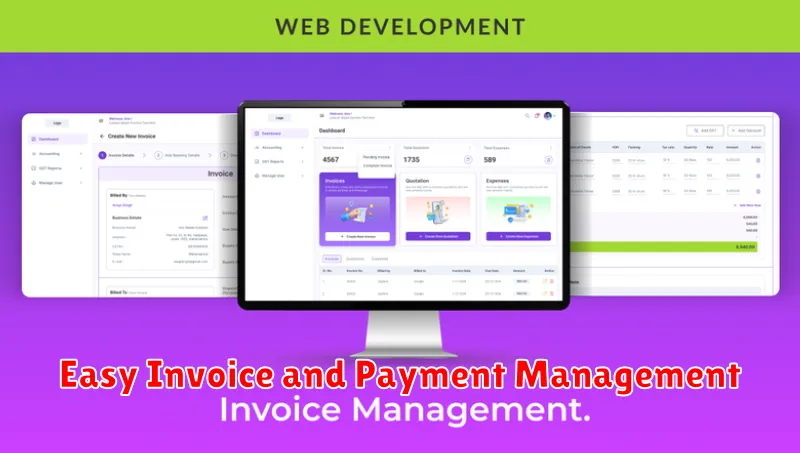

Easy Invoice and Payment Management

Digital banks often provide streamlined invoicing and payment solutions tailored for freelancers. These features can significantly reduce the administrative burden associated with managing finances.

Invoice Creation: Many platforms allow users to generate professional invoices directly within the banking interface. This eliminates the need for separate invoicing software and keeps all financial information centralized.

Payment Tracking: Real-time payment tracking provides instant visibility into which invoices have been paid and which are outstanding. This simplifies reconciliation and reduces follow-up time.

Multiple Payment Options: Supporting various payment methods, such as online transfers, credit card payments, and even international transfers, allows freelancers to accommodate clients’ preferences, potentially leading to faster payments.

Automated Reminders: Some digital banks offer automated payment reminders. This feature helps ensure timely payments without the awkwardness of manual follow-up, preserving client relationships.

Lower Fees for Transfers

Traditional banks often charge substantial fees for international transfers, wire transfers, and even sometimes for simple local transfers. These fees can significantly cut into a freelancer’s earnings, especially those who work with international clients or frequently transfer money between accounts.

Digital banks often offer significantly lower fees, and in some cases, even free transfers. This is a major advantage for freelancers who need to manage their finances efficiently and minimize expenses.

Lower transfer fees translate directly to higher retained earnings for freelancers. This can be especially beneficial for those just starting out or operating on tight margins.

Real-Time Earnings Overview

A key advantage of digital banking for freelancers is the ability to monitor earnings in real-time. This provides immediate visibility into financial inflows, allowing for better budgeting and financial planning. No more waiting for checks to clear or bank statements to arrive. With real-time updates, freelancers can instantly see the impact of completed projects on their available funds.

This feature also offers enhanced control over cash flow management. Freelancers can quickly identify potential shortfalls or surpluses, enabling proactive adjustments to spending or invoicing. This real-time insight facilitates informed financial decisions, contributing to greater financial stability.

Tax Preparation Support

One of the most significant challenges freelancers face is managing their taxes. Digital banks can offer valuable support in this area. Some banks provide integrated tax tools that help categorize income and expenses, making tax time less stressful. These tools may also estimate quarterly tax payments, helping freelancers avoid penalties.

Automated tax reporting features are another benefit. These features can generate reports that are ready to be submitted to tax authorities or shared with accountants, saving freelancers significant time and effort. Some digital banks even partner with tax professionals to offer discounted tax preparation services, providing a comprehensive solution for managing freelance finances.

Other tax support may include:

- Tax deadline reminders to help prevent late filing penalties.

- Educational resources on tax regulations specific to freelancing.

- Secure document storage for tax-related documents.

Mobile Access Anywhere

One of the most significant advantages of digital banks for freelancers is the unparalleled mobile access they offer. This allows for 24/7 account management from virtually any location.

This constant accessibility proves invaluable for freelancers who often work unconventional hours or travel frequently. Need to check your balance before invoicing a client from a coffee shop? Deposit a check while waiting for a meeting? Digital banks make these tasks quick and easy, streamlining financial management and allowing freelancers to focus on their work.

Features like mobile check deposit, real-time transaction notifications, and budgeting tools are often integrated within user-friendly mobile apps. These features provide freelancers with a comprehensive overview of their finances at their fingertips.