In today’s fast-paced world, convenience is key. Mobile check deposit offers a quick and easy way to manage your finances, eliminating the need for trips to the bank. Learn how to deposit checks from anywhere, anytime, using your mobile banking app. This guide will provide a step-by-step walkthrough of the process, addressing frequently asked questions and highlighting the benefits of mobile deposit.

Depositing checks has never been simpler. This article will demystify the mobile check deposit process, providing clear instructions on how to use your mobile app to deposit checks securely and efficiently. Discover the advantages of mobile banking and take control of your finances with this essential guide to mobile check deposit.

Digital Check Deposit Overview

Digital check deposit is a convenient and secure way to deposit checks using your mobile device. It eliminates the need to physically visit a bank or ATM, saving you time and effort.

The process typically involves taking pictures of the front and back of the check using your mobile app’s camera. The app then uses this information to electronically submit the check for deposit to your financial institution.

Key benefits of using digital check deposit include:

- 24/7 Availability: Deposit checks anytime, anywhere.

- Speed: Deposits are often processed faster than traditional methods.

- Ease of Use: Simply snap pictures and submit.

While digital check deposit offers many advantages, it’s important to be aware of potential limits such as deposit amount restrictions and cutoff times for processing.

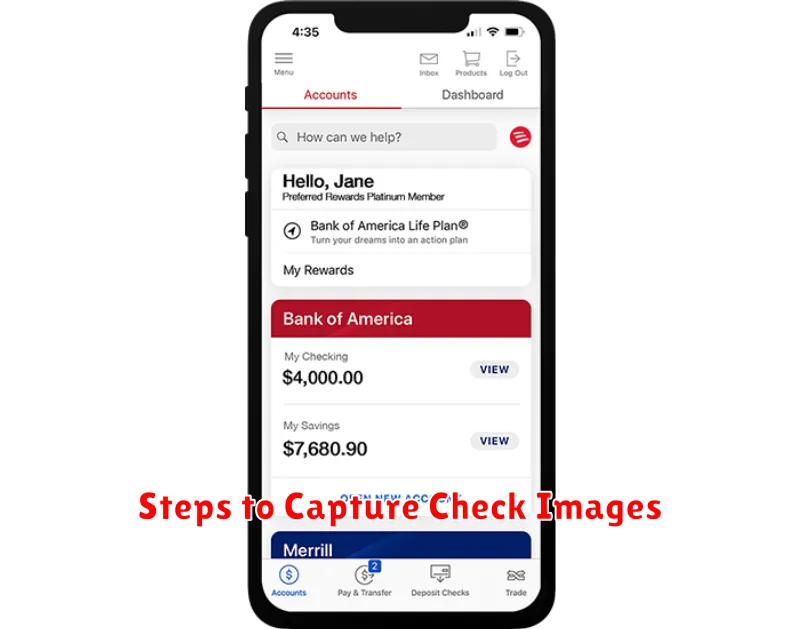

Steps to Capture Check Images

Ensure you have endorsed the back of your check. Most banks require a signature and sometimes the phrase “For Mobile Deposit Only”.

Open your mobile banking app and navigate to the check deposit feature. This is usually clearly labeled within the main menu or under a “Deposit” or “Transactions” section.

Select the account you wish to deposit the check into. Double-check that you’ve chosen the correct account to avoid any issues.

The app will prompt you to take a picture of the front of the check. Lay the check on a flat, dark, non-reflective surface. Ensure all four corners are visible within the designated frame. Take a clear, focused picture.

Repeat the process for the back of the endorsed check, following the same guidelines for image quality and positioning.

Review the images and the automatically extracted information, such as the check amount. If any information is incorrect, you may be able to edit it or retake the pictures. Verify all details before submitting.

Confirm the deposit. You will typically receive a confirmation message within the app. It is recommended to keep the physical check for a short period in case of processing errors, then destroy it securely.

Inputting Check Amount

After successfully capturing images of your check, the next crucial step is inputting the check amount. Accuracy is paramount in this step to ensure your deposit is processed correctly.

The app should automatically detect the amount from the check image. Carefully verify that the pre-filled amount matches the amount written on your check.

If the app doesn’t pre-fill the amount, or if the pre-filled amount is incorrect, you will need to manually enter it. Use the numeric keypad to input the exact amount, including cents, ensuring there are no typos or errors.

Double-check the entered amount before proceeding to the next step. Any discrepancy between the amount you enter and the amount written on the check could result in processing delays or rejection of your deposit.

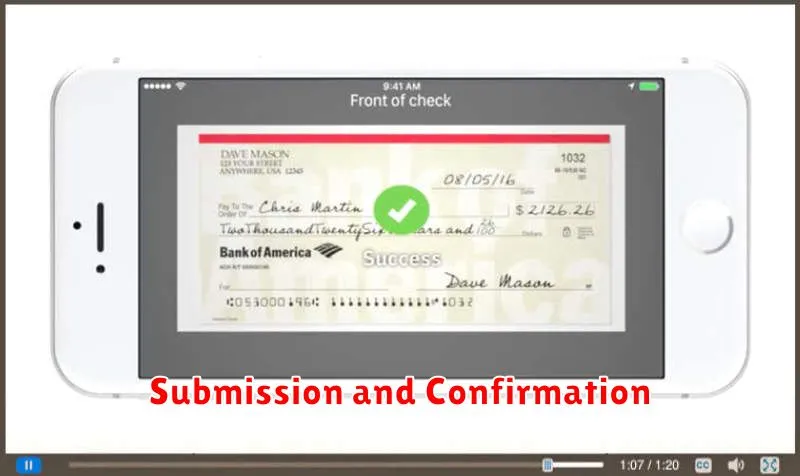

Submission and Confirmation

After reviewing the entered check information and ensuring its accuracy, you can proceed with the submission. Tap the Submit button to finalize the deposit. The app will then begin processing the check image.

Upon successful submission, you will receive a confirmation message. This message typically includes a confirmation number, the date and time of the deposit, and the amount deposited. It is advisable to save this confirmation for your records. Some apps may also offer the option to receive email notifications regarding the status of your mobile deposit.

The processing time for mobile check deposits can vary. Your bank’s funds availability policy dictates when the deposited funds will be available for use. This information is usually readily available within the app or on your bank’s website.

When Funds Are Available

Understanding when deposited funds become available is crucial for managing your finances. Generally, the first $225 of a mobile check deposit is available the next business day.

The remaining balance is typically available within two business days. However, some exceptions may apply which can affect the availability of funds.

These exceptions may include:

- Large deposits: Deposits exceeding a certain amount may take longer to process.

- New accounts: Funds may be held for a longer period for newly opened accounts.

- Deposit history: Your past deposit activity can influence the availability of funds.

- Suspected fraud: If any suspicious activity is detected, the bank may delay the availability of funds for further investigation.

It’s always recommended to check with your specific financial institution for their exact fund availability policy, as it can vary.

Troubleshooting Errors

Occasionally, you may encounter errors while attempting to deposit a check through the mobile app. This section addresses some common issues and provides potential solutions.

Check Image Issues

If you receive an error message related to the image quality, ensure the check is placed on a flat, dark, non-reflective surface. Proper lighting is crucial; avoid glare or shadows. Retake the photos, ensuring all four corners of the check are visible in the frame.

Endorsement Errors

Missing or incorrect endorsements can also cause rejection. Verify you have endorsed the check with your signature and, if required, “For Mobile Deposit Only.” If necessary, retake the photos after correcting the endorsement.

Deposit Limit Errors

You may encounter a message indicating you have exceeded your daily or monthly deposit limit. Contact your bank to inquire about your current limits or to request an increase if necessary.

App or System Errors

If you believe the error is related to the app or system itself, first try closing and restarting the app. If the issue persists, contact your bank’s customer support for further assistance.