Building a strong credit history is essential for financial success. It unlocks opportunities like securing loans, renting apartments, and even obtaining favorable insurance rates. However, establishing credit can be a challenging hurdle, especially for those new to the financial world. Digital banks offer innovative solutions to credit building, making the process more accessible and manageable than ever before. This article will explore how digital banks are helping individuals take control of their credit scores and build a positive financial future. We’ll delve into specific features and programs that provide opportunities for credit building, regardless of your current credit standing.

Traditional banking methods often present barriers to credit building, particularly for those with limited or no credit history. Digital banks are disrupting this landscape by offering secured credit cards, credit builder loans, and other innovative tools designed to help individuals establish and improve their credit scores. These digital banking platforms leverage technology to streamline the credit building process, providing personalized insights, automated savings plans, and accessible financial education resources. If you’re looking to improve your credit score or begin building a credit history from scratch, understanding the role of digital banks in credit building is a crucial first step.

Understanding Credit Scores

Credit scores are numerical representations of your creditworthiness, summarizing your credit history into a three-digit number. Lenders use these scores to assess the risk of lending you money. A higher score indicates a lower risk, suggesting you’re more likely to repay borrowed funds on time.

Several factors influence your credit score. Payment history is a crucial component, reflecting your track record of on-time payments. Amounts owed, length of credit history, credit mix (types of credit used), and new credit inquiries also play significant roles in determining your overall score. Different credit scoring models exist, but most range from 300 to 850, with higher scores being more desirable.

Understanding your credit score is essential for managing your finances effectively. It impacts your ability to secure loans, obtain favorable interest rates, and even rent an apartment. Regularly monitoring your credit report and score empowers you to identify potential errors and take steps to improve your credit health.

Credit-Builder Accounts

Credit-builder accounts are a powerful tool offered by many digital banks to help individuals establish or improve their credit scores. They function similarly to a secured loan. You deposit a certain amount of money which acts as collateral. Then, over a set period, you make regular “loan” payments to yourself. These payments are reported to the credit bureaus, demonstrating positive payment history.

Key advantages of using a credit-builder account through a digital bank include:

- Accessibility: Digital banks often have lower barriers to entry than traditional banks, making these accounts easier to obtain even with poor or no credit.

- Convenience: Manage your account entirely online, making payments and tracking progress easily.

- Affordability: Digital banks frequently offer lower fees than traditional institutions.

Upon successful completion of the program, you receive access to the initial deposit, effectively building savings while simultaneously building credit.

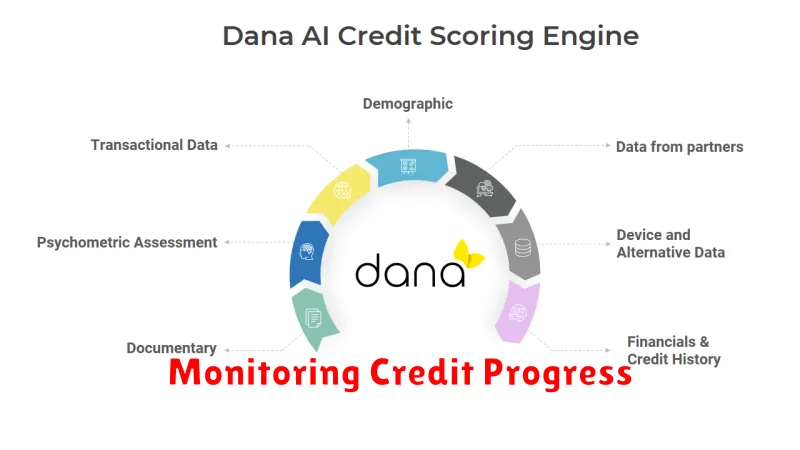

Monitoring Credit Progress

Digital banks offer a significant advantage in credit building through readily available credit monitoring tools. These tools provide a clear and concise overview of your credit score and its influencing factors.

Real-time updates are a key feature, allowing you to track changes to your score as they occur. This immediate feedback is crucial for understanding the impact of your financial decisions.

Many digital banks also offer personalized insights and recommendations based on your credit profile. These might include suggestions for improving your credit utilization ratio or advice on managing outstanding debts. This personalized guidance can be invaluable in making informed choices that positively impact your credit score.

Some platforms even provide alerts and notifications regarding significant changes to your credit report, such as new inquiries or late payments. This proactive approach helps you stay informed and address potential issues promptly.

Auto-Reporting to Bureaus

A key feature of many digital banks is their ability to automatically report your account activity to credit bureaus. This automated reporting can significantly streamline the credit-building process, removing the need for manual updates and ensuring consistent, accurate information is shared with the major credit reporting agencies.

Traditional banks may not always report all account types to credit bureaus, potentially limiting the positive impact of your responsible financial behavior. However, many digital banks prioritize reporting activity on accounts like secured credit cards and secured loans, which are specifically designed to help individuals establish or improve their credit history.

Consistent positive reporting of on-time payments and responsible account management through these digital platforms can contribute positively to your credit score over time. By automating this process, digital banks simplify a crucial step in building a strong credit profile.

Tips for Responsible Use

Managing your digital bank account responsibly is crucial for building credit effectively. Here are a few key tips to keep in mind:

Track Your Spending

Monitor your transactions regularly using the bank’s app or website. This helps you understand where your money is going and identify areas for potential savings. Budgeting tools, often provided within digital banking platforms, can assist with this process.

Avoid Overdrafts

Overdraft fees can negatively impact your finances. Set up low-balance alerts to avoid accidentally overdrawing your account. Consider linking a savings account as a backup for overdraft protection.

Make Timely Payments

Consistent, on-time payments are essential for building positive credit history. Utilize automatic payments or reminders to ensure you never miss a due date for any linked credit-building products.

Choosing the Right Digital Bank

Selecting the right digital bank for your credit-building journey requires careful consideration of several key factors. Fees are a crucial aspect. Look for banks that minimize or eliminate monthly maintenance fees, overdraft fees, and other charges that can eat into your progress.

Features designed to support credit building are essential. Look for options like secured credit cards, credit builder loans, or reporting of rent and utility payments to credit bureaus. Some digital banks offer personalized financial management tools, including budgeting assistance and spending trackers, which can be helpful for managing your finances effectively.

Customer service is another vital factor. A responsive and helpful customer support team can be invaluable, especially if you’re new to digital banking or encounter any issues. Finally, consider the bank’s overall reputation and stability. Choose a reputable institution with a strong track record and FDIC insurance to protect your funds.