In today’s fast-paced digital world, managing personal finances effectively is more critical than ever. Budgeting tools within digital banking apps offer a convenient and powerful way to track spending, save money, and achieve financial goals. These integrated tools provide a comprehensive overview of your financial activity, empowering you to make informed decisions about your money. This article explores the various budgeting tools available in digital banking apps, highlighting their benefits and how they can help you take control of your financial well-being.

From automated budgeting features to personalized insights and expense trackers, digital banking apps are transforming the way people manage their finances. By leveraging these integrated budgeting tools, users can gain a clearer understanding of their spending habits, identify areas for improvement, and ultimately work towards a more secure financial future. Understanding the functionalities and advantages of these digital banking budgeting tools is essential for anyone seeking to improve their financial literacy and take charge of their financial life.

Why Budgeting Matters

In the realm of personal finance, budgeting often emerges as a cornerstone of financial stability and success. A well-structured budget empowers you to take control of your finances, ensuring your income is allocated effectively to meet your financial goals.

Budgeting provides clarity into your spending patterns. By tracking income and expenses, you gain a comprehensive understanding of where your money goes, identifying areas of overspending and potential savings.

A budget acts as a roadmap, guiding your financial decisions. It helps you prioritize essential expenses, save for future goals like retirement or a down payment on a house, and avoid accumulating unnecessary debt.

Moreover, budgeting promotes financial security. By anticipating expenses and allocating resources accordingly, you are better prepared for unexpected financial challenges, reducing stress and anxiety related to money management.

Features to Look For

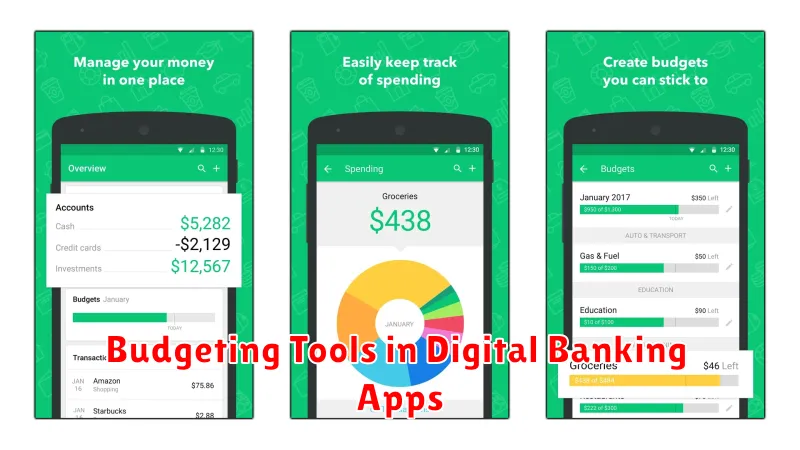

When selecting a budgeting tool within a digital banking app, several key features can significantly enhance your financial management experience. Look for tools that offer automatic categorization of transactions. This feature simplifies expense tracking by automatically assigning transactions to predefined categories like “Groceries” or “Entertainment.”

Customizable budgeting is another essential feature. The ability to create personalized spending categories and set realistic limits allows you to tailor the tool to your specific financial goals. Look for options to set spending alerts to help you stay within budget. Real-time tracking of your spending against your budget is also crucial for proactive financial management.

Visualizations, such as charts and graphs, can provide valuable insights into your spending patterns. These visual representations can help you identify areas where you might be overspending and make informed decisions about your finances.

Finally, consider the security features offered by the app. Data encryption and multi-factor authentication are crucial for protecting your sensitive financial information.

Setting Limits and Goals

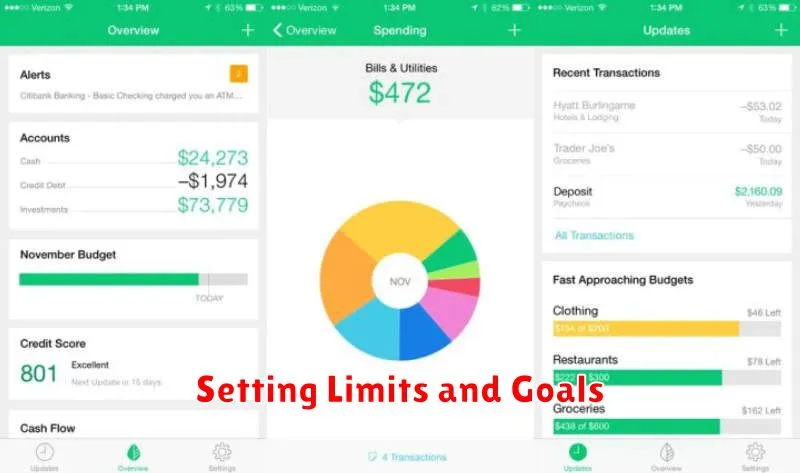

Digital banking apps often provide tools to help you set spending limits and financial goals. These features can be instrumental in managing your finances effectively.

Spending limits can be set for specific categories, such as dining or entertainment. Once you reach your predefined limit, the app may notify you, helping you stay within your budget. This feature promotes mindful spending and prevents overspending in areas prone to impulse purchases.

Goal setting tools allow you to define specific financial objectives, such as saving for a down payment or paying off debt. The app can track your progress towards these goals and may offer helpful visualizations, like progress bars or charts, to keep you motivated. Some apps even suggest personalized saving strategies based on your income and expenses.

Tracking Progress in Real-Time

One of the most significant advantages of budgeting tools within digital banking apps is the ability to track progress in real-time. This provides users with up-to-the-minute insights into their spending habits and budget adherence.

As transactions occur, they are automatically categorized and reflected against the user’s predefined budget. This immediate feedback allows for quick adjustments and prevents overspending. Users can easily monitor how much of their allocated budget remains for various categories, such as groceries, entertainment, or transportation.

Real-time tracking also facilitates proactive financial management. By observing spending patterns as they happen, users can identify potential areas for improvement and make informed decisions about their finances.

Best Budgeting Apps to Try

Managing finances effectively requires the right tools. Luckily, numerous budgeting apps offer diverse features to help track spending, set financial goals, and achieve financial stability. Choosing the best app depends on individual needs and preferences.

Some popular options include Mint, known for its comprehensive features and connection to bank accounts. YNAB (You Need a Budget) promotes a zero-based budgeting approach, giving every dollar a purpose. PocketGuard simplifies budgeting by calculating how much “safe to spend” after accounting for bills and savings goals. Personal Capital caters to those interested in investment tracking alongside budgeting. Goodbudget uses the envelope budgeting method for a more hands-on approach.

Consider factors like ease of use, available features, and cost when selecting an app. Some offer free versions with limited features, while others require subscriptions for premium functionality. Ultimately, the best budgeting app is one that effectively helps you manage your finances and achieve your financial objectives.

Syncing with Other Accounts

Many budgeting tools within digital banking apps offer the ability to sync with external accounts. This account aggregation feature provides a holistic view of your finances. By connecting checking accounts, savings accounts, credit cards, and even investment accounts held at other institutions, you gain a centralized platform for monitoring your overall financial health.

Syncing accounts allows the budgeting tool to automatically categorize transactions from all sources. This provides more accurate spending analysis and budget tracking.

Security is a paramount concern when syncing external accounts. Ensure the app uses strong encryption and multi-factor authentication to protect your sensitive financial information.