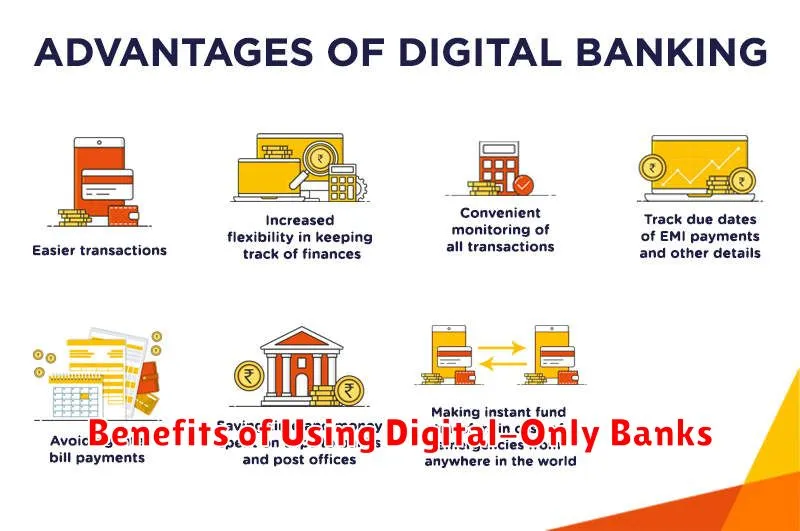

In today’s fast-paced world, managing your finances efficiently and conveniently is paramount. Digital-only banks, also known as online banks or virtual banks, offer a compelling alternative to traditional brick-and-mortar institutions. These innovative financial platforms leverage technology to provide a seamless and often more cost-effective banking experience. Exploring the benefits of using digital-only banks can reveal significant advantages in terms of higher interest rates on savings accounts, lower fees, and 24/7 access to your funds through user-friendly mobile apps and online platforms. This makes them an increasingly attractive option for modern consumers seeking greater control and flexibility over their finances. Are you ready to discover how a digital-only bank can transform your financial life?

This article will delve into the numerous benefits of using digital-only banks, highlighting their key features and advantages over traditional banking. We will explore how these institutions are disrupting the financial landscape by offering competitive interest rates, reduced fees, and innovative digital tools. From convenient mobile check deposits to real-time transaction notifications and robust security measures, digital-only banks are designed to meet the evolving needs of today’s tech-savvy consumers. By understanding the benefits of using digital-only banks, you can make an informed decision about whether this modern banking approach aligns with your financial goals and lifestyle.

What Are Digital-Only Banks?

Digital-only banks, also known as neobanks or virtual banks, are financial institutions that operate exclusively online. They have no physical branches, meaning all transactions and interactions are conducted through websites and mobile apps.

These banks offer a range of services comparable to traditional banks, including checking and savings accounts, money transfers, bill pay, and debit/credit cards. Some even offer investment and loan products.

By eliminating the overhead costs associated with physical branches, digital-only banks can often provide competitive interest rates and lower fees compared to traditional banks. They also tend to offer innovative features and a streamlined user experience within their apps.

No Physical Branches Needed

A key advantage of digital-only banks is the absence of physical branches. This eliminates the need for customers to travel to a physical location for banking services.

This translates to increased convenience, as customers can access their accounts and manage their finances anytime, anywhere, through their mobile devices or computers.

The lack of physical infrastructure also contributes to lower overhead costs for these banks, which can often be passed on to customers in the form of lower fees and better interest rates. This contributes to a more cost-effective banking experience overall.

Faster Account Opening

One of the most significant advantages of digital-only banks is the speed and efficiency of account opening. Traditional banks often involve lengthy paperwork, in-person visits, and processing times that can stretch for days or even weeks. Digital-only banks streamline this process significantly.

You can typically open an account entirely online, often in just a few minutes. This is achieved through automated identity verification processes and digital applications. No more waiting in lines or scheduling appointments.

This expedited process is especially beneficial for those who need immediate access to banking services or prefer the convenience of managing their finances entirely from their mobile devices.

24/7 Access from Anywhere

A key advantage of digital-only banks is their constant accessibility. Unlike traditional banks with limited branch hours, digital banks operate online, granting you access to your funds and banking services anytime, anywhere, through a computer or mobile device.

This 24/7 availability offers unparalleled convenience. Need to check your balance at 3 AM? Transfer money on a Sunday? Digital banks empower you to manage your finances whenever necessary, without being constrained by traditional banking schedules.

This flexibility is especially beneficial for those who travel frequently or have busy, unpredictable schedules. It removes the limitations of physical locations and allows for instant banking on the go.

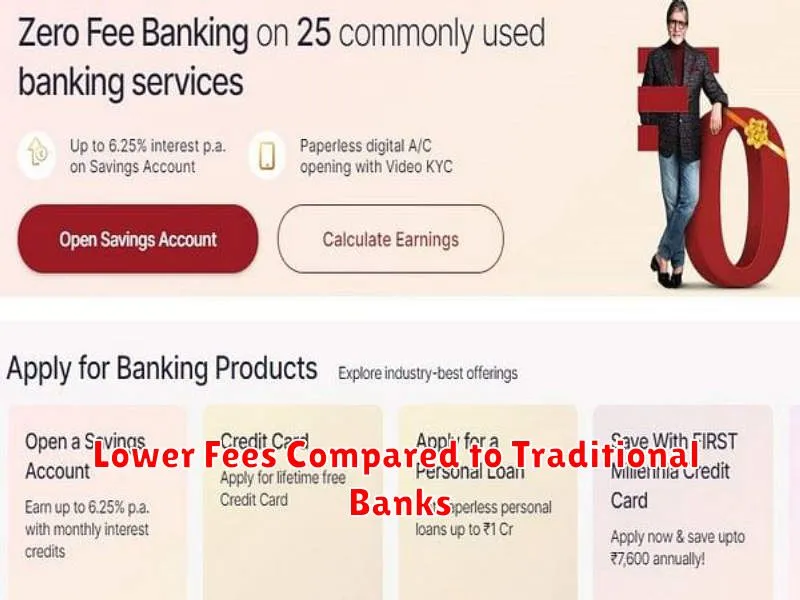

Lower Fees Compared to Traditional Banks

A significant advantage of digital-only banks lies in their typically lower fee structure compared to traditional brick-and-mortar institutions. This cost savings is often passed on to customers.

Traditional banks frequently charge monthly maintenance fees, overdraft fees, and ATM fees. Digital banks often waive these fees, or offer significantly reduced rates. This can result in substantial savings for customers, especially those who maintain smaller balances or frequently use ATMs.

For example, a traditional bank might charge $10-$15 per month for a checking account, while a digital bank may offer the same service free of charge. Similarly, overdraft fees can be considerably less, sometimes even non-existent with certain digital banks.

Eco-Friendly and Paperless

Digital-only banks contribute significantly to a greener environment by operating entirely paperless. Traditional banks rely heavily on paper for account statements, checks, and various forms. This digital approach eliminates the need for physical documents, reducing deforestation and minimizing the carbon footprint associated with paper production and transportation.

By opting for digital banking, customers actively participate in environmental conservation. They reduce their own paper consumption and contribute to a more sustainable future.

This eco-conscious approach also extends to reduced energy consumption. Physical branches require significant energy to operate, while digital banks minimize this impact by operating virtually.