Managing your finances effectively often involves automating routine tasks, and few are more crucial than setting up automatic payments. With online banking, taking control of your bills and recurring expenses becomes significantly easier. This article provides a comprehensive guide to setting up automatic payments through your online bank, saving you time and ensuring you never miss a payment deadline. Whether you’re looking to automate bill payments for utilities, credit cards, or recurring subscriptions, understanding the process for your specific online banking platform is essential. Learn how to navigate your online bank’s interface, add payees, schedule payments, and manage your automatic payment settings efficiently.

Successfully managing your automatic payments via online banking offers a multitude of benefits. From avoiding late fees and improving your credit score to simplifying your financial tracking and reducing the risk of missed payments, the advantages are numerous. This guide will walk you through the steps required to set up automatic payments with your online bank, ensuring you understand the security measures in place and empowering you to make informed decisions about managing your finances. Learn about the different types of automatic payments you can set up, including one-time and recurring payments, and understand how to modify or cancel existing automatic payments as needed. Take control of your financial obligations and discover the convenience of online banking with automatic payments.

Benefits of Auto-Pay

Auto-pay offers several advantages for managing your finances. Convenience is a key benefit, eliminating the need to remember payment due dates and manually submit payments each month. This reduces the risk of late payments and associated penalties.

Improved credit score is another potential benefit. Consistent, on-time payments through auto-pay contribute positively to your payment history, a crucial factor in determining your creditworthiness.

Time savings is a significant advantage. Automating payments frees up time previously spent on manual payment processing, allowing you to focus on other important tasks.

Reduced stress is an often overlooked benefit. Automating recurring bills eliminates the mental burden of remembering due dates and ensuring timely payments, providing peace of mind.

Better financial organization is also achievable with auto-pay. By automating payments, you create a predictable and organized payment schedule, simplifying budgeting and financial tracking.

How to Schedule Recurring Payments

Scheduling recurring payments through your online banking platform offers convenience and helps avoid late payment fees. Most banks provide user-friendly interfaces for setting up these automated transactions.

Typically, you’ll begin by logging into your online banking account. Then, navigate to the bill pay or payments section. Look for an option related to recurring payments, automatic payments, or scheduled payments. The specific wording may vary depending on your bank.

You’ll need to provide some key information about the payment. This includes the payee’s name, their account number (if applicable), the payment amount, the frequency (e.g., monthly, quarterly), and the start date for the recurring payments. Some banks also allow you to set an end date if the payments are for a limited time.

Carefully review all the details before confirming the recurring payment. Once scheduled, monitor your account statements to ensure the payments are processing correctly.

Choosing Payment Dates Carefully

Timing is a crucial factor when setting up automatic payments. Selecting the appropriate payment date can prevent late fees, overdraft charges, and ensure your payments are processed smoothly.

Consider aligning your payment dates with your income schedule. If you receive your salary on the 15th of each month, scheduling payments for the 16th or later ensures sufficient funds are available in your account. This avoids potential issues caused by processing delays or unexpected expenses.

Be mindful of due dates. While aligning with your pay schedule is important, ensure automatic payments are scheduled a few days before the actual due date. This buffer provides a margin of safety in case of unforeseen circumstances or technical glitches. Review the payment processing times for each biller to avoid any late payment penalties.

Managing Bills with One App

Managing bills can often be a tedious task, involving multiple due dates, various platforms, and the risk of late payments. Utilizing a single application to centralize bill management offers a streamlined and efficient solution.

Many online banking platforms offer bill pay features within their apps. This allows users to schedule payments, track due dates, and review payment history all in one place. The convenience of having all your bills accessible within your banking app eliminates the need to log into multiple websites or use separate apps for each biller.

Some apps even provide alerts and notifications for upcoming due dates, ensuring timely payments and avoiding late fees. This feature offers peace of mind and helps users maintain a positive credit history.

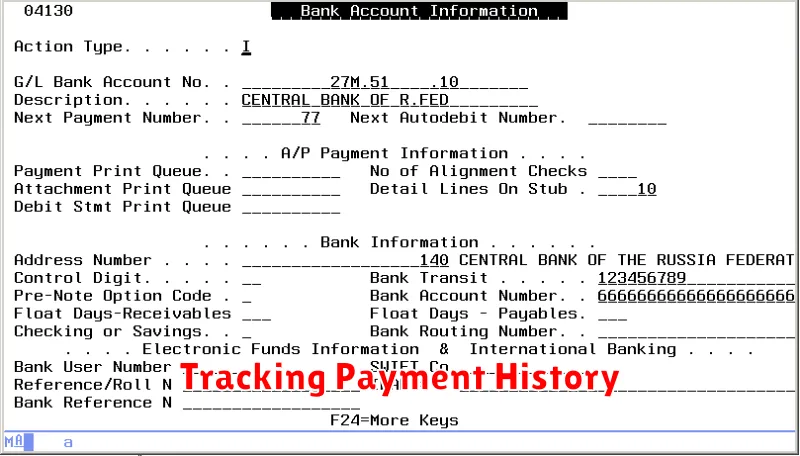

Tracking Payment History

Maintaining accurate records of your automatic payments is crucial for effective financial management. Online banks provide various tools to help you track your payment history efficiently.

Typically, your online banking platform will have a dedicated section for viewing past payments. This section often allows you to filter payments by date, amount, or recipient. You can usually access details like the confirmation number, payment date, and the status of each transaction (e.g., completed, pending, or failed).

Some banks offer downloadable payment history, usually in CSV or PDF format. This feature allows you to integrate your payment data with personal finance software or create your own spreadsheets for analysis. Be sure to regularly review your payment history to verify the accuracy of transactions and identify any potential issues.

Canceling or Editing Schedules

Canceling an automatic payment typically involves logging into your online banking account and navigating to the “Bill Pay” or “Payments” section. Locate the scheduled payment you wish to cancel and select the option to delete or cancel it. Some banks may require confirmation or a reason for cancellation.

Editing a scheduled payment often follows a similar process. After locating the desired payment, look for an “Edit” or “Modify” option. You can typically adjust the payment amount, date, or recipient information. Be sure to save the changes after making any edits. It’s crucial to make these changes before the processing date to ensure they take effect for the next payment.

Policies for canceling and editing schedules vary among financial institutions. Some banks impose deadlines for changes, while others may charge fees for certain modifications. Consult your bank’s terms and conditions or contact their customer support for specific details regarding their policies.